Understanding the True Cost of Clean, Reliable Power

Hydropower project costs are among the most complex in the renewable energy sector, with investment expenses ranging from $1,050 to $8,000 per kilowatt depending on project size and type. Key costs include Capital Expenditures (CAPEX), Operations & Maintenance (O&M), and financing, which combine to determine the Levelized Cost of Electricity (LCOE). Costs vary significantly, from as low as $500/kW for retrofits to over $7,900/kW for new developments.

When you’re considering a hydropower investment, you’re looking at a capital-intensive technology that can operate for 50 to 100+ years with relatively low ongoing costs. However, projects regularly run millions over budget, with timelines stretching years beyond original plans. In 2022, the global weighted average total installed cost of new hydropower projects jumped 25% to $2,881/kW.

This cost volatility raises electricity prices for consumers, makes private investors nervous, and can hinder environmental goals if projects become too expensive. Yet hydropower remains essential. It generates 16% of the world’s electricity and provides grid stability that intermittent renewables like solar and wind cannot match. Understanding what drives these costs—and how to control them—is critical for anyone involved in hydropower projects.

I’m Bill French Sr., Founder and CEO of FDE Hydro™, and I’ve spent over five decades in heavy civil construction before focusing on reducing hydropower project costs through modular precast technology. My experience includes managing $200M annual construction operations and participating in the Department of Energy’s Hydro Power Vision Technology Task Force, where we defined next-generation solutions for clean energy infrastructure.

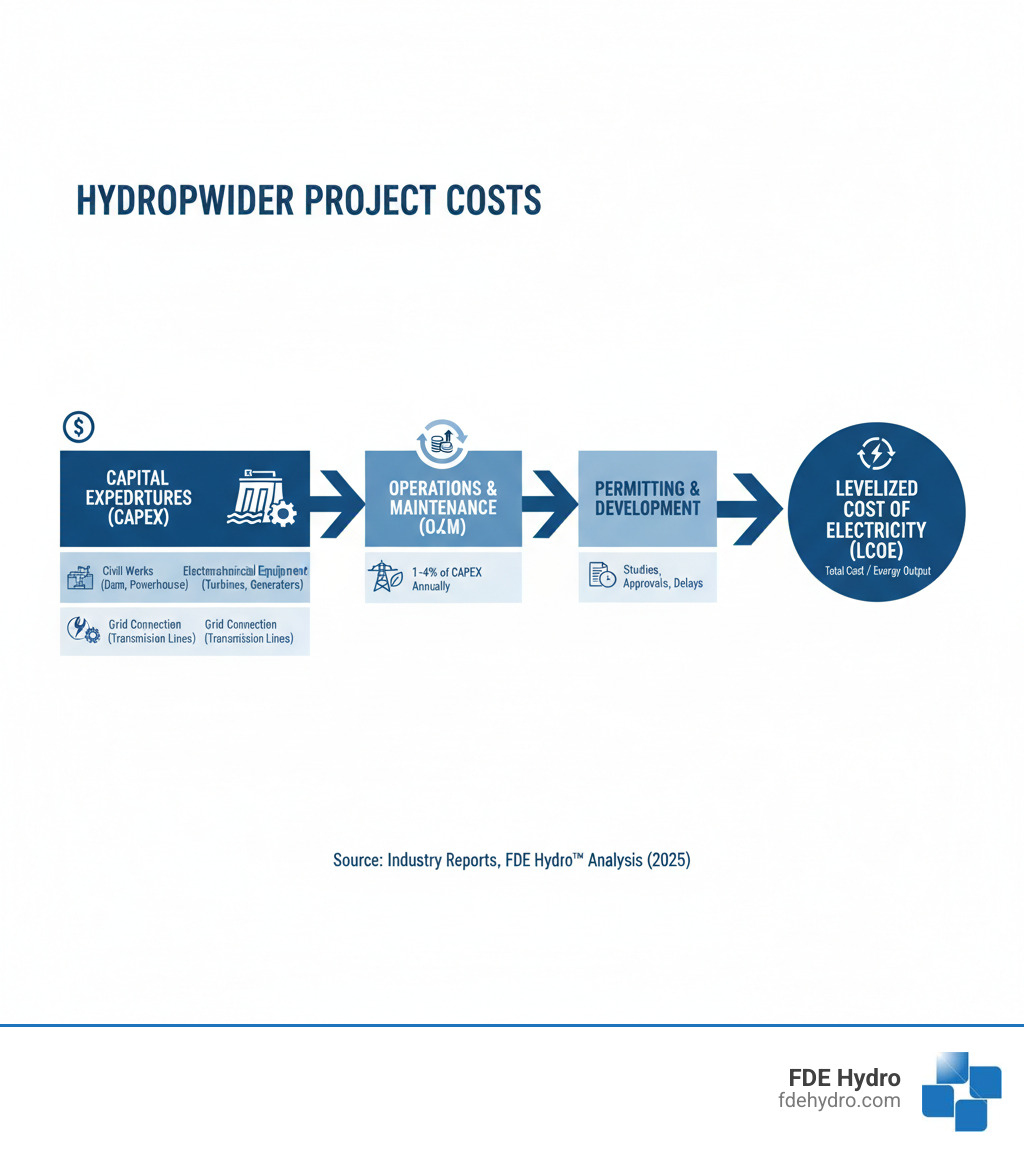

Deconstructing Hydropower Costs: From Initial Investment to Long-Term Operation

Understanding hydropower project costs means looking at the entire financial journey, from the initial investment through decades of operation. Let’s break down the core financial metrics that define the true cost of using water power.

Breaking Down Capital Expenditures (CAPEX) in hydropower project costs

Capital Expenditures (CAPEX) represent the upfront spending to get a hydropower plant from blueprint to operation. This is the largest portion of hydropower project costs.

The numbers vary wildly. Large hydropower plants typically cost between $1,050 and $7,650 per kilowatt, while small projects can run from $1,300 to $8,000 per kilowatt. Building on an existing, non-powered dam can be much cheaper—as low as $500 per kilowatt—because the primary dam structure is already in place.

The 2024 Annual Technology Baseline shows U.S. costs for retrofitting Non-Powered Dams range from $3,045 to $20,043 per kilowatt, while building from scratch (New Stream-Reach Development) runs higher at $6,574 to $8,611 per kilowatt.

CAPEX is driven by two main categories: civil works (dams, tunnels, powerhouses) and electro-mechanical components (turbines, generators, transformers). For large projects, civil works are the biggest expense. For smaller projects, the sophisticated machinery can cost more per kilowatt.

Cost trends are concerning. IRENA’s 2022 report showed the global weighted average installed cost jumped 25% in a single year, driven by cost overruns, supply chain disruptions, and inflation.

This is why we developed our modular precast concrete technology at FDE Hydro™. The “French Dam” approach tackles rising CAPEX by manufacturing standardized components in a factory. This cuts construction time, reduces on-site labor, and eliminates many of the surprises that send traditional projects over budget.

For a closer look at one of the more complex types of hydropower projects with unique capital considerations, check out More info about Pumped Storage Hydropower.

Understanding Operations & Maintenance (O&M) in hydropower project costs

After construction, ongoing Operations and Maintenance (O&M) costs begin. O&M covers everything needed to keep the facility running, including inspections, repairs, and staffing.

O&M costs are typically 1% to 4% of the initial installed cost annually. For a $500 million plant, that’s $5 to $20 million per year.

Size matters. Large projects benefit from economies of scale, with O&M costs around 2% to 2.5% of CAPEX. Small projects lack this luxury, and their O&M costs can range from 1% to 6% because fixed costs like inspections and insurance represent a larger portion of their budget.

Hydropower plants can operate for 50 to 100 years or more, but aging infrastructure requires increasing maintenance. Planning for these long-term needs is essential for a plant’s economic viability.

The Levelized Cost of Electricity (LCOE)

The Levelized Cost of Electricity (LCOE) is the ultimate metric, representing the average cost per kilowatt-hour over a plant’s entire lifetime. It allows for apples-to-apples comparisons between different energy technologies.

For hydropower, the LCOE is very competitive. Refurbishment projects can achieve an LCOE as low as $0.01 to $0.05 per kilowatt-hour. New large projects typically land between $0.02 and $0.19 per kilowatt-hour. The global weighted average LCOE for hydropower in 2022 was $0.061 per kilowatt-hour.

According to IRENA’s 2022 cost report, 86% of all newly commissioned renewable capacity in 2022 had lower costs than fossil fuel-fired electricity. Despite construction cost increases, hydropower’s LCOE remains lower than the cheapest new fossil fuel options. Combined with a 50-to-100-year lifespan and zero fuel costs, hydropower delivers incredible long-term value.

Key Factors Influencing Hydropower Project Costs

There is no “standard” price for a hydropower project. The final hydropower project costs depend on a complex interplay of variables, from plant type and site geology to operational efficiency.

Project Type and Primary Components

While all conventional hydropower facilities share components like dams, turbines, and generators, their configuration dramatically impacts the budget. The three main types are:

- Run-of-river hydropower: Relies on the river’s natural flow with minimal storage. These projects typically have lower civil works costs and environmental impact but produce variable power.

- Reservoir hydropower: The traditional large dam approach, creating significant water storage for controlled, dispatchable electricity generation. This flexibility comes with very high civil works costs and longer construction timelines.

- Pumped storage hydropower: Acts like a giant battery, using two reservoirs to store energy by pumping water uphill when electricity is cheap and releasing it to generate power when demand is high. It requires high investment in civil works and equipment.

The site-specific nature of hydropower project costs cannot be overstated. A plant on stable bedrock near grid connections will cost far less than one in a remote area requiring extensive tunneling. At FDE Hydro™, our modular precast technology brings predictability to construction, helping to control costs regardless of site conditions.

Capacity Factor and Site Hydrology

The capacity factor—the ratio of actual energy output compared to the maximum possible output—is a crucial metric. A higher capacity factor means more electricity is generated, which lowers the Levelized Cost of Electricity (LCOE) and improves financial returns.

Site hydrology is the biggest influence on capacity factor. The river’s natural flow, including seasonal variations, dictates how much power can be generated. Climate change is adding complexity through more frequent droughts and extreme weather. The U.S. Hydropower Market Report (2023) noted that median capacity factors ranged from 33% to 45% between 2005 and 2022, varying significantly by region and year.

Design choices, such as selecting the right turbine type and sizing the plant appropriately for the site’s water availability, also play a key role. Finally, operational characteristics matter; plants with large reservoirs can store water and dispatch power strategically, often achieving higher and more consistent capacity factors than run-of-river plants.

Recent Market Trends and Cost Drivers

In recent years, hydropower costs have been climbing. According to IRENA, hydropower experienced an 18% cost increase in 2022, contributing to a 25% jump in the global weighted average installed cost to US$2,881/kW. From 2010 to 2022, total installed costs for hydropower more than doubled.

Several factors are behind this trend:

- Supply chain challenges: Global disruptions have increased the cost and lead times for critical components like steel, concrete, and turbines.

- Inflationary pressures: Rising costs for raw materials, labor, and transportation have eroded project budgets.

- Cost overruns in large projects: IRENA highlighted that overruns in numerous large projects contributed significantly to the overall cost increase.

Unlike solar and wind, which benefit from mass-produced, modular components, large hydropower projects are typically custom-built, site-specific endeavors. This makes them more susceptible to cost escalation and delays. This is the problem we’re tackling at FDE Hydro™. Our modular precast concrete technology brings the advantages of factory production and rapid assembly to hydropower, reducing construction time and the risk of cost overruns.

The Hidden Costs: Navigating Risks and Financial Problems

When evaluating hydropower project costs, the initial budget is only part of the story. A complex web of financial risks and “hidden costs” can determine a project’s viability and its attractiveness to private investors.

The Challenge of Cost Overruns and Permitting

Cost overruns are a systemic problem in the hydropower industry. Projects routinely exceed their budgets and timelines, threatening the sector’s competitiveness.

The primary causes include:

- Long project timelines: A decade-long project is exposed to years of potential economic shifts, policy changes, and inflation.

- Complex civil engineering: Building massive structures in challenging geological sites often leads to unexpected complications, each adding time and money.

- Lengthy permitting: The regulatory process is notoriously slow. In the U.S., the median duration for hydropower relicensing from 2010 to 2022 was 5.8 years, with some cases exceeding 12 years. Each month of delay adds financing costs and uncertainty.

When hydropower project costs spiral, consumers may pay higher electricity prices. Research shows this can push consumers toward cheaper fossil fuel alternatives, undermining the project’s environmental goals. For more on this, Research on cost overrun impacts offers valuable insights.

The Critical Role of the Cost of Capital

Hydropower is a capital-intensive technology with nearly all costs paid upfront, followed by decades of zero fuel costs. This makes the cost of capital a critical component of hydropower project costs.

The Weighted Average Cost of Capital (WACC) has an outsized impact on the final price of electricity. Research shows that a one percent increase in WACC can raise generation costs by seven to 14 percent. This sensitivity is a major challenge in emerging and developing economies, where higher perceived investment risks lead to higher capital costs, slowing the energy transition.

At FDE Hydro™, we understand that reducing construction time and uncertainty with our modular technology directly addresses this financing challenge. Shorter construction periods mean less risk exposure, making projects more attractive to investors and lowering overall capital costs.

For more on this topic, explore our article on Financing Long-Term Hydropower Requires Mitigating Risks Prior to ROI.

Revenue, Offtake, and Policy Risks

Even after construction, a project faces ongoing financial uncertainties. These revenue and policy risks are critical to long-term viability.

- Unremunerated Services: Hydropower provides valuable grid stability, flexibility, and flood control, but these services are often undervalued or not compensated at all.

- Climate Uncertainty: Erratic rainfall patterns and droughts make future revenue streams harder to predict, which makes investors nervous.

- Offtake Risk: Securing a long-term power purchase agreement (PPA) with a creditworthy buyer is essential for obtaining project financing.

- Policy Gaps: Fewer than 30 countries have policies that directly support hydropower development, creating an uncertain regulatory environment for long-term investments.

Until more countries adopt comprehensive policy frameworks that recognize hydropower’s full value, this lack of targeted support will continue to discourage private investment. To learn more about efforts to address these challenges, read our article on Reinvigorating Hydropower.

The Future of Hydropower: Innovation, Potential, and Grid Stability

Despite cost challenges, hydropower’s future is bright, shaped by technological innovation, vast untapped potential, and its essential role in a stable, renewable-powered grid.

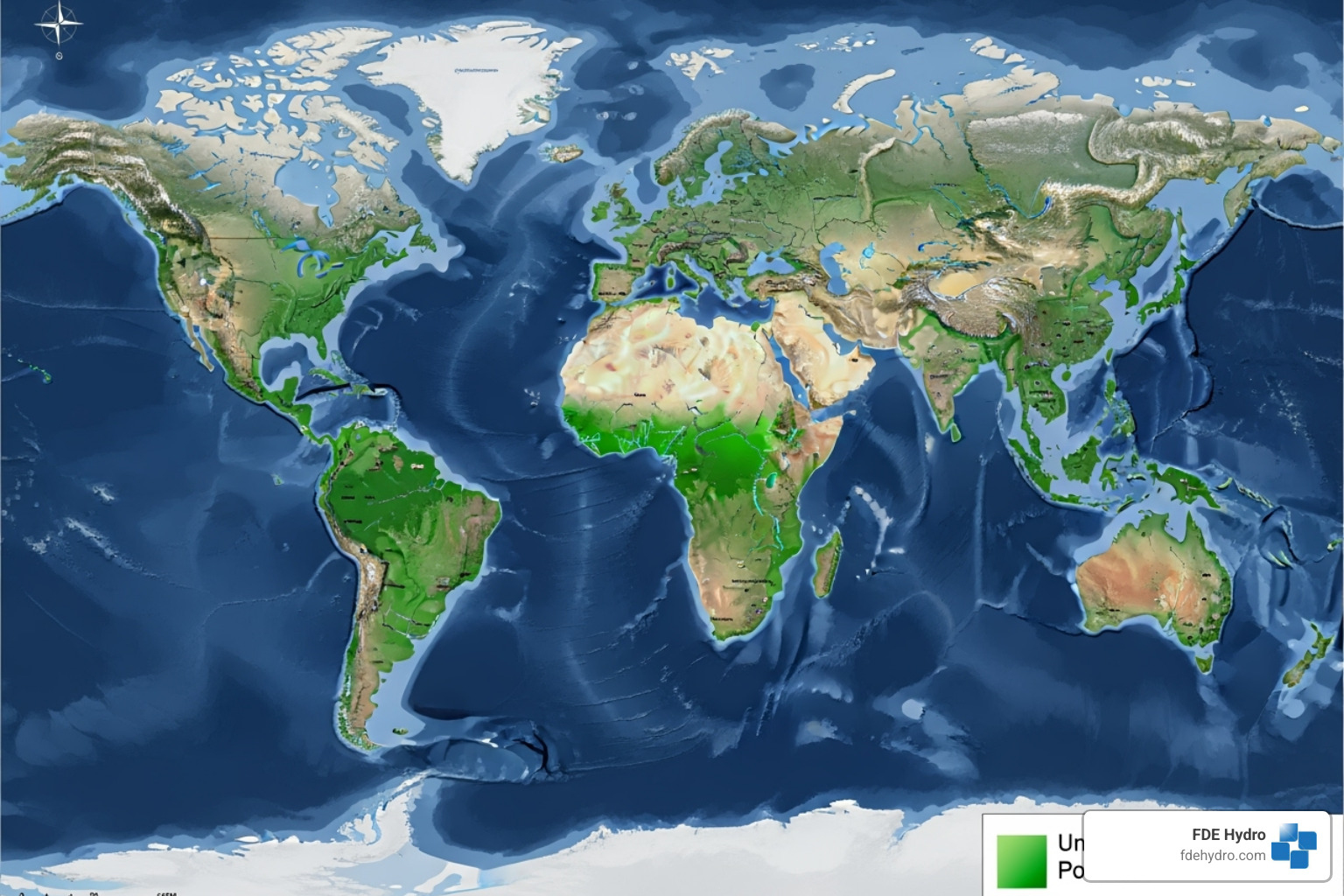

Global Potential and Grid Integration

The estimated worldwide technical potential for hydropower is 15,955 TWh per year—nearly five times what we generate today. Much of this potential lies in developing regions like sub-Saharan Africa, Southeast Asia, and Latin America, where new projects could transform energy access and economic development.

Beyond generation, hydropower is critical for grid stability. It provides the flexibility and storage needed to integrate variable renewables like wind and solar. While solar and wind are intermittent, hydropower—especially reservoir and pumped storage schemes—can respond to demand fluctuations in minutes.

Pumped storage hydropower is currently the only large-scale, cost-efficient energy storage technology available, acting as a giant battery for the grid. This ability to store and rapidly dispatch energy makes hydropower an indispensable partner for wind and solar, ensuring grid reliability as we transition away from fossil fuels.

Effectively managing hydropower project costs is key to enabling this broader renewable energy transition. For more on this, see 4 Reasons Why Hydropower is the Guardian of the Grid.

Technology Innovation Scenarios

The future of hydropower project costs will be shaped by innovation. The 2024 Annual Technology Baseline (ATB) outlines three scenarios:

- Conservative Scenario: Assumes no significant technological changes, with costs remaining static.

- Moderate Scenario: Envisions incremental improvements and best practices becoming widespread, leading to modest cost reductions (e.g., a 4% CAPEX reduction for Non-Powered Dams by 2040).

- Advanced Scenario: Projects significant gains from cutting-edge technologies like modularity, advanced manufacturing, and automation. This could lower CAPEX by an additional 10% by 2040 and reduce O&M costs by up to 45% by 2050.

At FDE Hydro™, our modular precast concrete technology—the “French Dam”—aligns perfectly with this Advanced Scenario. By manufacturing standardized components in a factory, we streamline construction, reduce project timelines, and cut costs, directly addressing the largest components of CAPEX. We have successfully deployed this technology on projects in North America, Brazil, and Europe, proving that innovation can make hydropower more affordable and quicker to build, a vision endorsed in The U.S. Department of Energy Hydropower Vision Report Endorses FDE Technology.

The ATB projects base year overnight capital costs for Nonpowered Dams (NPD) from $3,045/kW to $20,043/kW, and for New Stream-Reach Development (NSD) from $6,574/kW to $8,611/kW. Targeted innovation, like ours, can push costs toward the lower end of these ranges and beyond.

Frequently Asked Questions about Hydropower Costs

What is the average investment cost for a new hydropower plant?

There’s no single average cost, as projects are highly site-specific. However, typical ranges provide a good starting point. Large hydropower plants generally cost between USD 1,050/kW and USD 7,650/kW. Small hydropower projects fall in a similar but slightly higher range, from USD 1,300/kW to USD 8,000/kW.

Retrofitting existing dams is often the most cost-effective option, with costs as low as USD 500/kW. This is because the expensive civil infrastructure is already in place, dramatically reducing overall hydropower project costs.

Why do hydropower projects often experience cost overruns?

Cost overruns are a persistent challenge in the hydropower industry, driven by a few key factors:

- Long Timelines: Projects can take over a decade from planning to operation, exposing them to inflation, economic shifts, and policy changes.

- Complex Construction: Building large dams and tunnels in challenging geological conditions often leads to unforeseen issues that cause delays and increase costs.

- Lengthy Permitting: The regulatory approval process is notoriously slow and unpredictable. In the U.S., the median time for relicensing was nearly six years between 2010 and 2022.

At FDE Hydro™, our modular precast technology helps combat these issues by standardizing components and accelerating construction, leading to more predictable hydropower project costs.

How does hydropower’s cost compare to solar and wind?

While hydropower often has a higher upfront capital cost per kilowatt, it’s a fundamentally different type of investment. A hydropower plant can operate for 50 to 100 years or more, two to four times longer than a typical solar or wind farm. This longevity significantly lowers its lifetime cost.

Hydropower also has a higher capacity factor (the percentage of time it generates power) and provides essential grid stability and storage that intermittent renewables like solar and wind cannot offer on their own. Hydropower can ramp up in minutes to balance the grid when solar or wind output drops.

When you consider its long lifespan, reliability, and grid services, hydropower’s Levelized Cost of Electricity (LCOE) is highly competitive. In 2022, its global weighted average LCOE of $0.061/kWh was lower than the cheapest new fossil fuel options. Hydropower and solar/wind are not competitors but complementary partners in the clean energy transition.

Conclusion

We’ve seen that hydropower project costs are complex, encompassing massive upfront Capital Expenditures from $1,050 to $8,000 per kilowatt, ongoing O&M, and a competitive Levelized Cost of Electricity. The final price tag is shaped by project type—whether run-of-river, reservoir, or pumped storage—and the unique characteristics of each site.

However, hidden costs and risks often pose the greatest challenges. Cost overruns, driven by long timelines and complex permitting, are a systemic issue. The cost of capital has an outsized impact, as a mere 1% increase in financing rates can raise generation costs by 7% to 14%. Furthermore, projects face revenue uncertainty, as invaluable services like grid stability, flood control, and irrigation often go uncompensated.

Despite these problems, hydropower’s future is essential. With a global technical potential nearly five times greater than current generation, it is the backbone of a stable renewable energy grid. As solar and wind capacity grows, hydropower’s ability to provide storage and flexibility becomes more critical than ever.

Technology innovation is the key to open uping this potential. At FDE Hydro™, our modular precast concrete technology directly tackles the construction delays and cost overruns that have long plagued the industry. By standardizing components and shortening timelines, we are making hydropower more predictable, affordable, and faster to deploy.

The path forward requires addressing financial and regulatory barriers through supportive policies and innovative financing. Managing hydropower project costs is not just an economic exercise; it’s essential for building the clean, reliable energy future our world needs.

If you’re exploring hydropower development and want to understand how to steer these financial challenges, we invite you to learn more about Financing Long-Term Hydropower Requires Mitigating Risks Prior to ROI.