The Environmental Price of Digital Gold

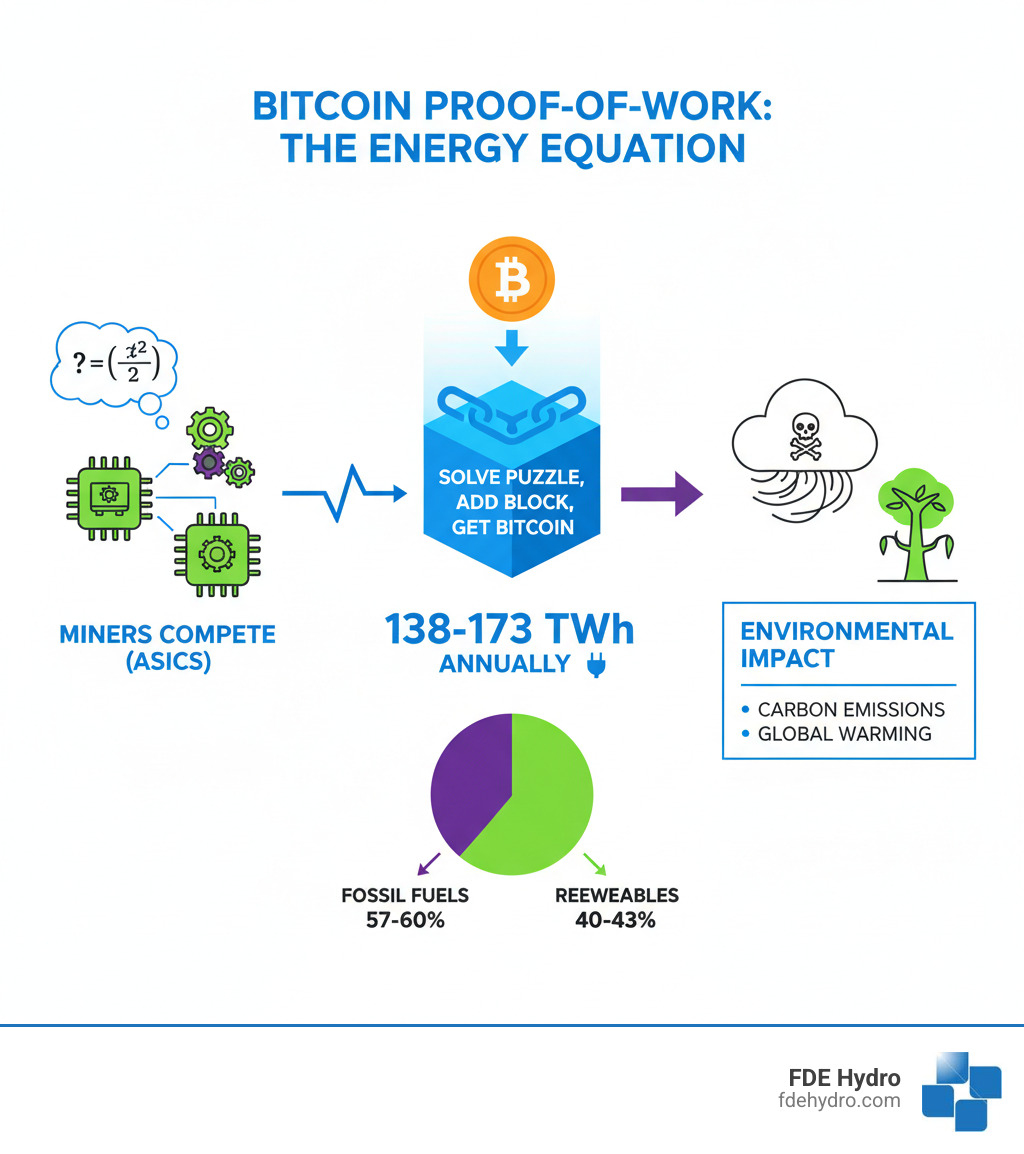

Crypto mining sustainability is a critical concern as the industry consumes vast amounts of energy and generates significant environmental impacts:

- Energy Consumption: Bitcoin mining alone uses 138-173 TWh annually, equivalent to countries like Ukraine or Poland

- Carbon Emissions: Global crypto mining produces 39.8-90.6 million tonnes of CO₂ annually

- Current Renewable Mix: Only 41-43% of Bitcoin’s energy comes from renewable sources as of 2024

- Health Impact: 1.9 million Americans are exposed to higher air pollution from mining operations

- Water & E-Waste: Mining consumes 1.65 billion cubic meters of water annually and generates significant electronic waste

Cryptocurrency mining has evolved from a niche technical pursuit into a global industry with a massive environmental footprint. Bitcoin, often called “digital gold,” reached a market capitalization exceeding $1.3 trillion by 2024. But this digital wealth comes at a real-world cost. The infrastructure supporting mainstream cryptocurrencies uses enormous amounts of energy—173.42 terawatt hours annually according to recent studies. That’s more electricity than entire nations consume.

The environmental impact extends far beyond energy consumption. Recent research reveals troubling effects on air quality, water resources, and land use. A Harvard-led study found that Bitcoin mining exposes millions of Americans to harmful fine particulate air pollution. The UN documented water usage sufficient to meet the domestic needs of over 300 million people in rural Sub-Saharan Africa. And mining operations generate mounting piles of electronic waste as specialized hardware becomes obsolete in as little as 1.3 years.

This raises urgent questions. Can an industry built on computing power ever be truly sustainable? Is the innovation worth the environmental price? And what solutions exist that could reconcile digital advancement with ecological responsibility?

As Bill French Sr., Founder and CEO of FDE Hydro™, I’ve spent decades in heavy civil construction and the past nine years focused on modular hydropower solutions designed to benefit present and future environments. My work with the Department of Energy’s Hydro Power Vision Task Force and development of innovative hydropower technologies has given me unique insight into how crypto mining sustainability can be achieved through clean, renewable energy integration.

The Unquenchable Thirst: Bitcoin’s Massive Energy Consumption

Bitcoin mining consumes 173.42 terawatt hours of electricity annually—more than entire countries like Ukraine or Poland. If Bitcoin were a country, it would rank 27th globally in energy use, consuming more power than Pakistan.

This represents about 0.5% of all electricity used on Earth. For comparison, the entire global payment system (credit cards, bank transfers) uses only 0.2%. Bitcoin alone uses more than double that.

The culprit is Bitcoin’s Proof-of-Work mechanism. Miners compete to solve complex puzzles, with the winner adding a block to the blockchain and earning Bitcoin. This relentless competition drives ever-increasing energy use.

For crypto mining sustainability, the power source is critical. As of 2025, 43% comes from renewables. The remaining 57% relies on fossil fuels (38% natural gas, 9% coal) and nuclear (10%). While the trend is positive, most of Bitcoin’s power still harms our planet.

On a per-transaction basis, the numbers are even more sobering. A single Bitcoin transaction uses an estimated 500 kilowatt hours, while a VISA transaction uses just 0.001 kWh—a difference of 500,000 times.

You can explore more detailed comparisons through this analysis: Bitcoin’s energy use compared to countries.

The Carbon Footprint of a Digital Asset

This electricity use translates directly into staggering carbon emissions.

Bitcoin’s annual carbon footprint equals burning 84 billion pounds of coal or running 190 natural gas power plants for a year. To offset this naturally, you’d need to plant 3.9 billion trees—a forest the size of the Netherlands.

Economically, between 2016 and 2021, every dollar of Bitcoin mined caused 35 cents in climate damage. This accounts for real-world costs like health impacts and extreme weather, leading some to call Bitcoin “digital crude” instead of “digital gold.”

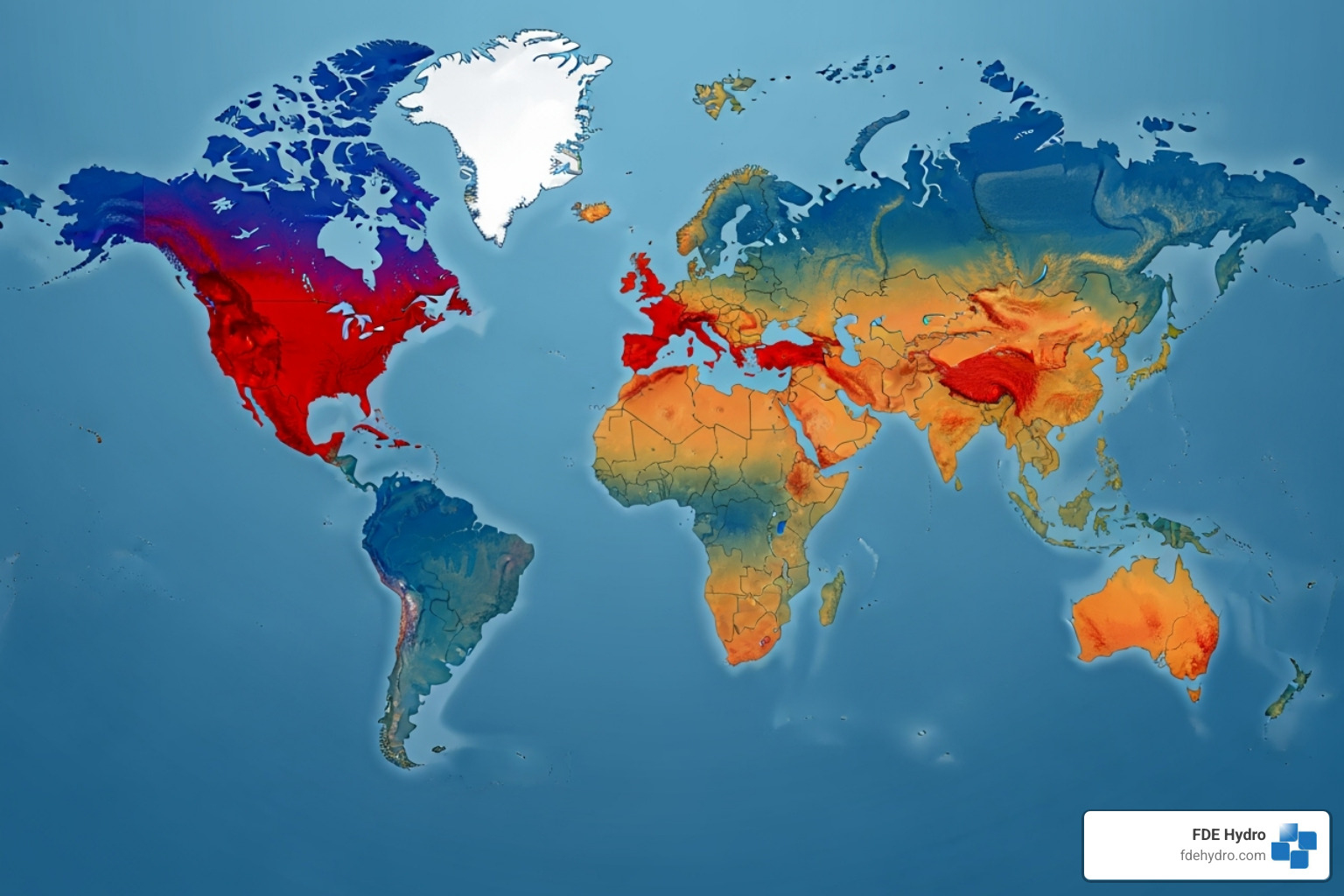

As of 2025, Bitcoin produces 39.8 million tonnes of CO₂ annually, comparable to the carbon footprint of Slovakia. These figures show that Bitcoin mining creates serious environmental challenges. They highlight why a shift to clean energy, especially stable solutions like hydropower, is essential for the industry and our planet.

Beyond Carbon: The Hidden Environmental Costs

Bitcoin’s environmental impact goes beyond carbon emissions. While CO₂ gets the headlines, the true cost of crypto mining sustainability challenges affects our air, water, and land. These hidden costs impact communities, ecosystems, and public health in ways that are often overlooked.

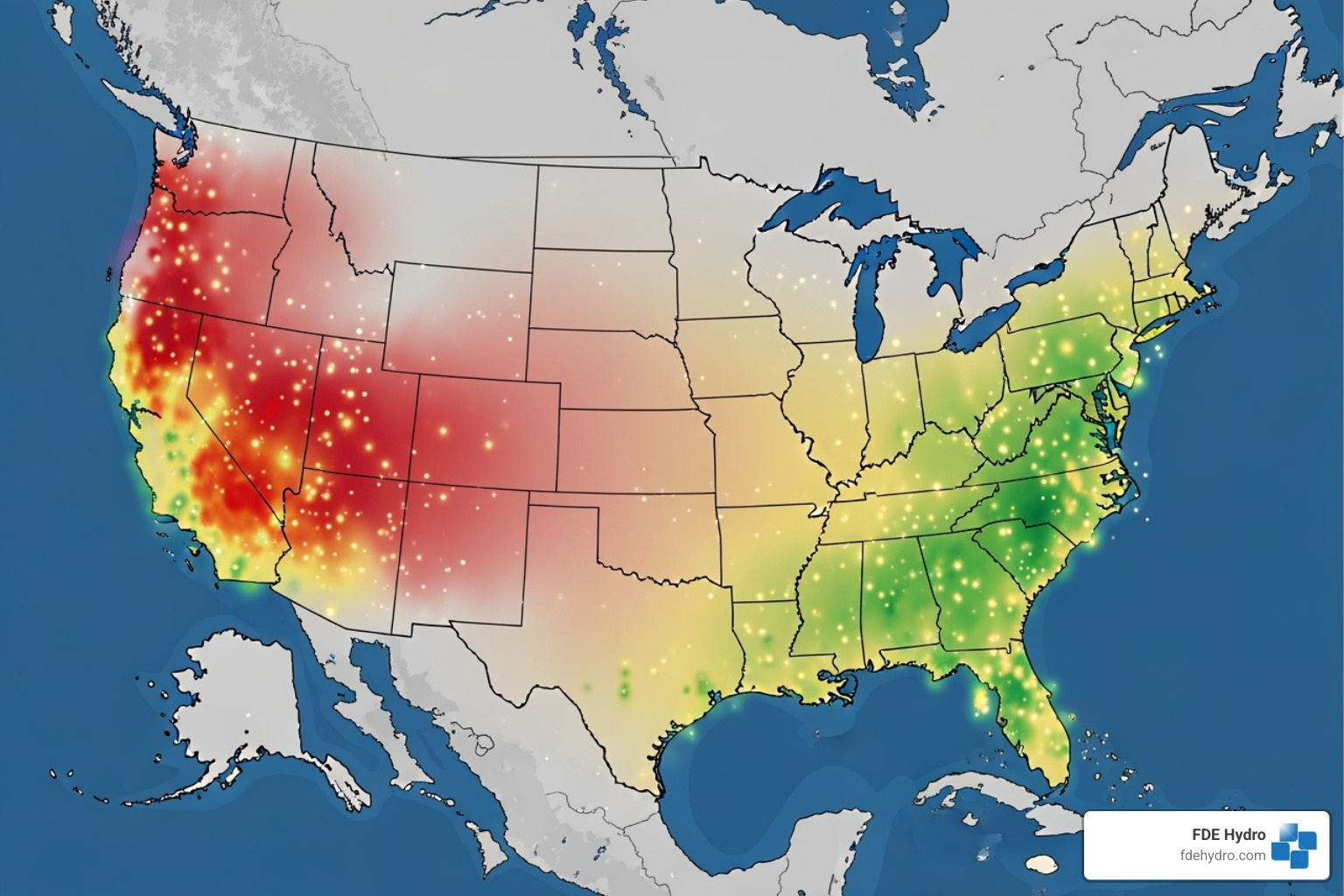

Air Pollution: A Cross-State Public Health Concern

A groundbreaking Harvard-led study on Bitcoin mining’s air pollution revealed that mining significantly increases fine particulate air pollution (PM2.5). These microscopic particles are linked to serious health conditions like cancer, heart disease, and dementia.

The connection is straightforward: most large-scale U.S. Bitcoin mines draw power from fossil fuel plants. Burning coal or natural gas for mining’s massive electricity needs releases PM2.5 and other pollutants.

The 34 largest U.S. Bitcoin mines consumed 33% more electricity than Los Angeles from August 2022 to July 2023. This resulted in an estimated 1.9 million Americans being exposed to higher PM2.5 pollution from mining.

The challenge is that pollution crosses state borders. A North Carolina mine might use power from a Kentucky plant, with pollution drifting to Illinois. This creates a regulatory nightmare, as states cannot unilaterally regulate emissions from their neighbors, underscoring the need for federal action.

Water, Land, and Electronic Waste

The footprint extends to water, land, and e-waste. Mining hardware requires massive amounts of water for cooling. Bitcoin’s global water footprint in 2020-2021 reached 1.65 cubic kilometers—enough for the domestic needs of over 300 million people in rural sub-Saharan Africa.

At FDE Hydro, we work to harness water power sustainably. The contrast between water as a renewable solution and water consumed for cooling is stark. You can explore water’s potential as a climate solution in The Biggest Untapped Solution to Climate Change is in the Water and learn about Hydropower.

Land use is another challenge. The global Bitcoin mining network’s land footprint in 2020-2021 was over 1,870 square kilometers, 1.4 times the area of Los Angeles. Responsible land use requires thoughtful, long-term planning.

Then there’s the electronic waste problem. Bitcoin mining uses specialized hardware (ASICs) that become obsolete quickly. The average lifespan is just 1.3 years, though some studies suggest 4-5 years. This rapid turnover creates over 30,000 tonnes of e-waste annually (2021), with each transaction generating about 272 grams. The volume creates a significant environmental burden, along with noise pollution from cooling fans.

For a comprehensive look at these interconnected environmental impacts, the UN study on Bitcoin’s environmental footprint provides valuable insights into how crypto mining sustainability must address far more than just carbon emissions.

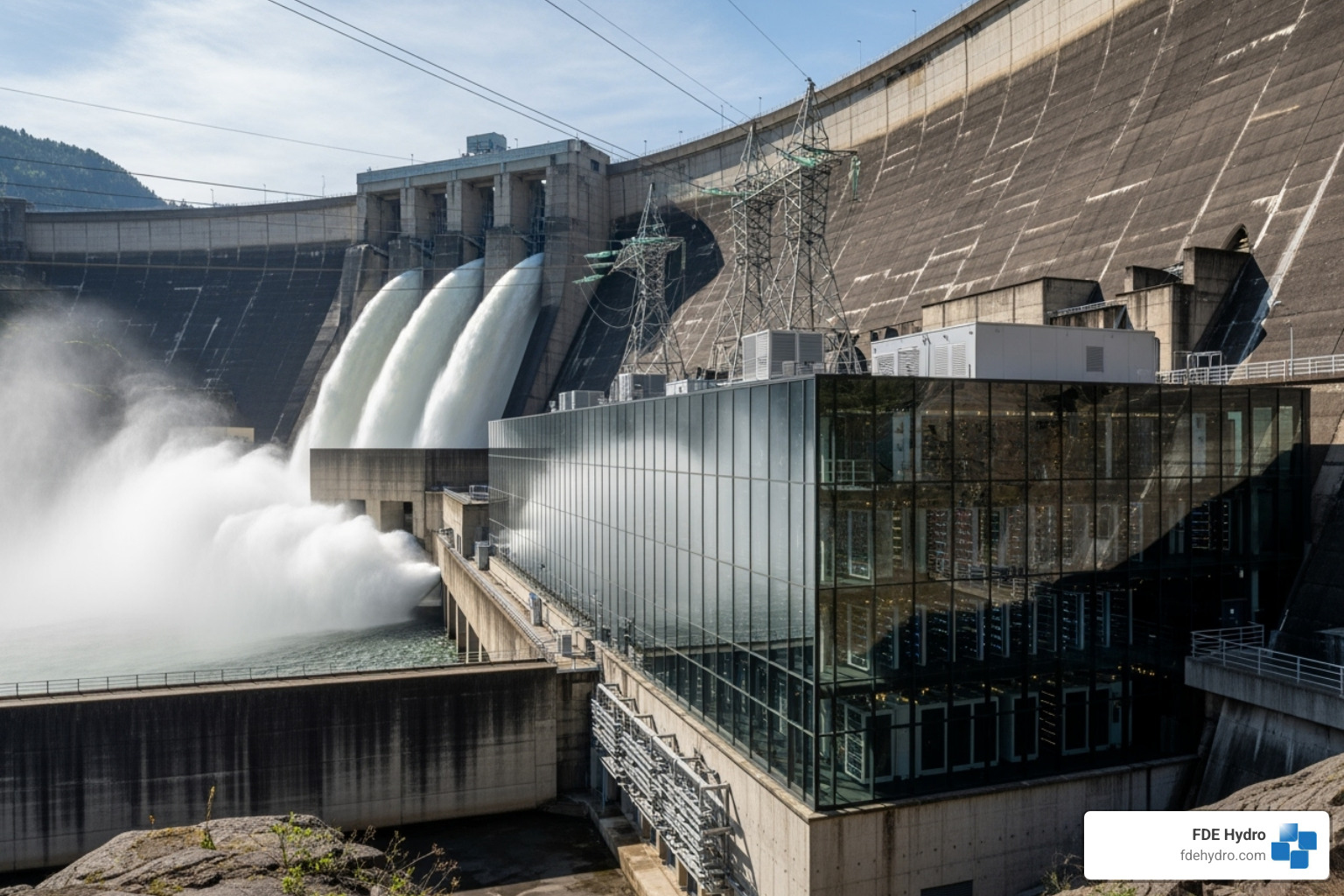

The Path to Crypto Mining Sustainability

The environmental challenges are urgent, but the path to crypto mining sustainability is within reach through practical solutions. Clean, renewable energy—especially hydropower—is central to balancing technological progress with environmental stewardship. As a developer of modular hydropower, I’ve seen how the right infrastructure can transform industries. The crypto mining sector is at a crossroads, and its direction will shape the future of digital currency and our planet.

Key Challenges for Crypto Mining Sustainability

Achieving sustainable Bitcoin mining isn’t simple. Several challenges stand in the way.

The intermittency problem is the biggest hurdle. Solar and wind are not constant, but Bitcoin mining runs 24/7, demanding reliable electricity. This mismatch, without massive energy storage, leads to unpredictable power. In the competitive Proof-of-Work race, downtime means lost revenue, pushing miners toward reliable but dirty fossil fuels.

Next is the “green Bitcoin” problem. All Bitcoin is identical, whether mined with hydropower or coal. There’s no premium for sustainably mined coins. Conscious miners invest in clean energy but receive no market reward, while those using the cheapest (often dirtiest) power face no penalty. As of 2023, U.S. Bitcoin miners still drew 54% of their power from fossil fuels.

When externalities aren’t priced in—when miners don’t pay for the pollution they create—the market naturally favors the cheapest energy. The price-security feedback loop in Proof-of-Work intensifies this, rewarding computational power above all else while society bears the environmental costs. For a deeper dive into these systemic barriers, this academic research offers valuable insights: Barriers to sustainable Bitcoin mining.

Innovations and Solutions for Sustainable Crypto Mining

The transition to crypto mining sustainability is already happening, driven by smart technology, strategic energy partnerships, and thoughtful policy.

Co-locating mining operations with renewable energy projects is a promising strategy, especially with stable sources like hydropower. Unlike solar and wind, hydropower is dispatchable—you can control its output to match demand. Water stored behind a dam represents stored energy, making hydropower the perfect partner for energy-hungry operations like crypto mining.

At FDE Hydro, our modular hydropower solutions make clean energy deployment faster and more affordable. Our patented “French Dam” technology dramatically reduces the cost and time to build or retrofit hydroelectric facilities. These efficient, modular systems can bring reliable, clean hydropower to data centers and mining operations at scale. The potential is enormous, including Reinvigorating Hydropower infrastructure that already exists.

Beyond direct power supply, Bitcoin mining can support renewable energy development. Miners can act as flexible loads, consuming excess renewable energy. This improves the economics of renewable projects. Some miners even use methane that would otherwise be vented from oil wells and landfills, offering a carbon-negative contribution. In 2024, about 2.38% of Bitcoin’s energy came from this source.

The trends are positive. The renewable share in Bitcoin’s global energy mix climbed from 20% in 2011 to 41% in 2024, with projections suggesting at least 70% by 2030. This shift is driven by miners seeking cheaper power, greening energy grids, and stricter regulations.

Policy interventions are crucial. Subsidies for green energy and carbon taxes can accelerate the transition. Regulations in Canada and Iceland require environmental assessments. In the U.S., the White House and EPA are studying impacts, while states like New York have imposed moratoriums on new fossil fuel-powered operations.

Our work extends beyond traditional hydropower. We’re developing Microgrid and Pumped Storage Hydropower systems that provide grid stability and energy storage. These technologies create resilient energy systems for sustainable data centers. We actively participate in industry discussions about these innovations, as highlighted in our Recording: Innovating the Future: Cleantech and Energy Storage Panel Discussion.

The path forward is clear: we must choose clean energy over fossil fuels. This ensures technological progress serves both innovation and environmental responsibility. With the right infrastructure, smart policies, and industry leadership, we can build a digital economy that thrives without sacrificing our planet. That’s not just good for the environment—it’s good business.

Frequently Asked Questions about Crypto’s Environmental Impact

How does Bitcoin’s energy use compare to VISA?

The difference between Bitcoin and traditional payment systems is eye-opening. A single Bitcoin transaction gobbles up roughly 500 kWh of electricity. Compare that to a VISA transaction, which uses about 0.001 kWh. That’s right—one Bitcoin transaction uses thousands of times more energy than swiping your credit card at the grocery store.

When we zoom out to look at the big picture, it becomes even more striking. The entire global payment system—every credit card swipe, every digital payment, every ATM withdrawal—uses about 0.2% of the world’s electricity. Bitcoin mining alone consumes 0.5% of global electricity. Think about that for a moment: a single cryptocurrency uses more than twice the energy of the entire traditional financial transaction infrastructure that serves billions of people daily.

This comparison highlights why crypto mining sustainability isn’t just an environmental talking point—it’s an urgent challenge that demands innovative solutions.

Can crypto mining ever be truly green?

Yes, we genuinely believe crypto mining can become truly green. But let’s be honest: it won’t happen overnight, and it requires fundamental changes across the entire industry.

The potential is real. As of 2024, Bitcoin’s energy mix already includes about 41% renewable sources, and projections suggest this could reach 70% by 2030. That’s encouraging progress, but we need to push further toward 100% clean energy. This is where stable, dispatchable renewable sources like hydropower become absolutely critical. Unlike solar and wind, which fluctuate with weather conditions, hydropower provides the consistent, round-the-clock power that mining operations demand.

The path forward requires several key elements working together. We need a major shift in the energy mix, moving mining operations to facilities powered entirely by renewables. Technological advancements matter too—both in developing more energy-efficient mining hardware and in the broader adoption of alternative consensus mechanisms that don’t require massive computational power. And supportive regulations must create real incentives for green mining while penalizing reliance on fossil fuels.

At FDE Hydro, we’re working to provide exactly the kind of clean energy infrastructure this transition requires. Our modular hydropower technology can deploy reliable, renewable power faster and more affordably than traditional dam construction. By co-locating mining operations with hydropower facilities, we can dramatically reduce environmental impact while supporting the digital economy. The technology exists—now we need the will to implement it at scale.

What is being done to regulate crypto mining’s pollution?

The regulatory landscape for crypto mining looks like a patchwork quilt, with different jurisdictions taking dramatically different approaches.

China took the most extreme stance, implementing a complete ban on all cryptocurrency mining activities in 2021. Energy consumption and environmental concerns drove this decision, and it instantly reshaped the global mining landscape as operations scrambled to relocate.

The European Union has taken a more measured but still serious approach. EU regulators have actively debated banning energy-intensive Proof-of-Work mining altogether. While they haven’t pulled that trigger yet, they’ve made it clear that cryptocurrencies need to transition toward more sustainable consensus mechanisms. The pressure is mounting.

In the United States, the response has been fragmented. The White House Office of Science and Technology Policy and the EPA have launched studies examining the energy usage and environmental footprint of crypto assets. But without unified federal regulation, individual states are charting their own courses. New York, for instance, has placed moratoriums on new fossil fuel-powered crypto mining plants. Meanwhile, Texas has rolled out the welcome mat with tax incentives, hoping to put excess energy to use and potentially manage methane emissions from oil and gas operations.

This state-by-state patchwork creates real challenges. Harvard study we discussed earlier? It revealed how air pollution from mining operations crosses state lines—a Bitcoin mine in North Carolina might draw power from a Kentucky plant, and the resulting pollution drifts into Illinois. No single state can effectively regulate these cross-border impacts alone. This reality underscores the need for federal intervention, potentially through EPA regulations requiring stricter emissions controls from power plants that supply mining operations.

The global regulatory picture reveals an industry at a crossroads, with governments worldwide struggling to balance innovation with environmental responsibility.

Conclusion: Reconciling Digital Innovation with Environmental Responsibility

Our exploration of Bitcoin’s environmental impact has taken us through some sobering territory. The numbers tell a powerful story: energy consumption rivaling entire nations, carbon emissions equivalent to burning 84 billion pounds of coal, and 1.9 million Americans breathing polluted air from mining operations. Add to that a massive water footprint, significant land use, and mountains of electronic waste. The environmental price tag attached to our “digital gold” is substantial.

Yet the biggest challenges often present the greatest opportunities for innovation. The path to crypto mining sustainability isn’t a fantasy—it’s an engineering problem waiting for practical solutions.

We face significant problems like the intermittency of solar and wind, the lack of market differentiation for “green” Bitcoin, and economic pressure driving miners toward fossil fuels. These are real obstacles, but they’re not impossible.

The solution lies in a three-pronged approach: technological innovation, smart regulation, and a fundamental shift toward clean energy sources. This is where hydropower’s unique advantages become clear. Unlike intermittent renewables, hydropower delivers stable, dispatchable energy around the clock. It’s the reliable backbone that crypto mining needs to go truly green.

At FDE Hydro, we’ve spent nine years developing modular hydropower solutions to meet modern energy challenges. Our patented “French Dam” technology can deploy hydroelectric systems faster and more cost-effectively, allowing crypto mining operations to partner with stable, carbon-free power sources.

The industry is already moving in the right direction. The renewable energy share in Bitcoin mining grew to 41% in 2024, with projections suggesting 70% by 2030. We’re seeing miners co-locate with renewable projects and even tap methane that would otherwise be vented. These are smart business decisions that prove sustainability and profitability can work hand in hand.

But we can’t rely on market forces alone. Smart policy interventions—carbon taxes, green energy subsidies, and regulations that protect public health—will accelerate this transition. The digital economy and environmental responsibility don’t have to be at odds. As we continue innovating, we must build on a foundation of ecological stewardship. That means choosing reliable renewable energy sources like the hydropower systems we’re developing to power tomorrow’s sustainable infrastructure.

The technology exists. The economic incentives are aligning. The regulatory momentum is building. What we need now is commitment—from miners, policymakers, investors, and energy providers—to make crypto mining sustainability the standard, not the exception.

I invite you to explore how our hydropower innovations can contribute to a cleaner, more sustainable digital future: Learn more about our innovative hydropower solutions.