The Staggering Scale of Crypto’s Energy Appetite

Crypto mining power consumption is a major environmental issue of the digital age. The cryptocurrency industry’s energy use is staggering:

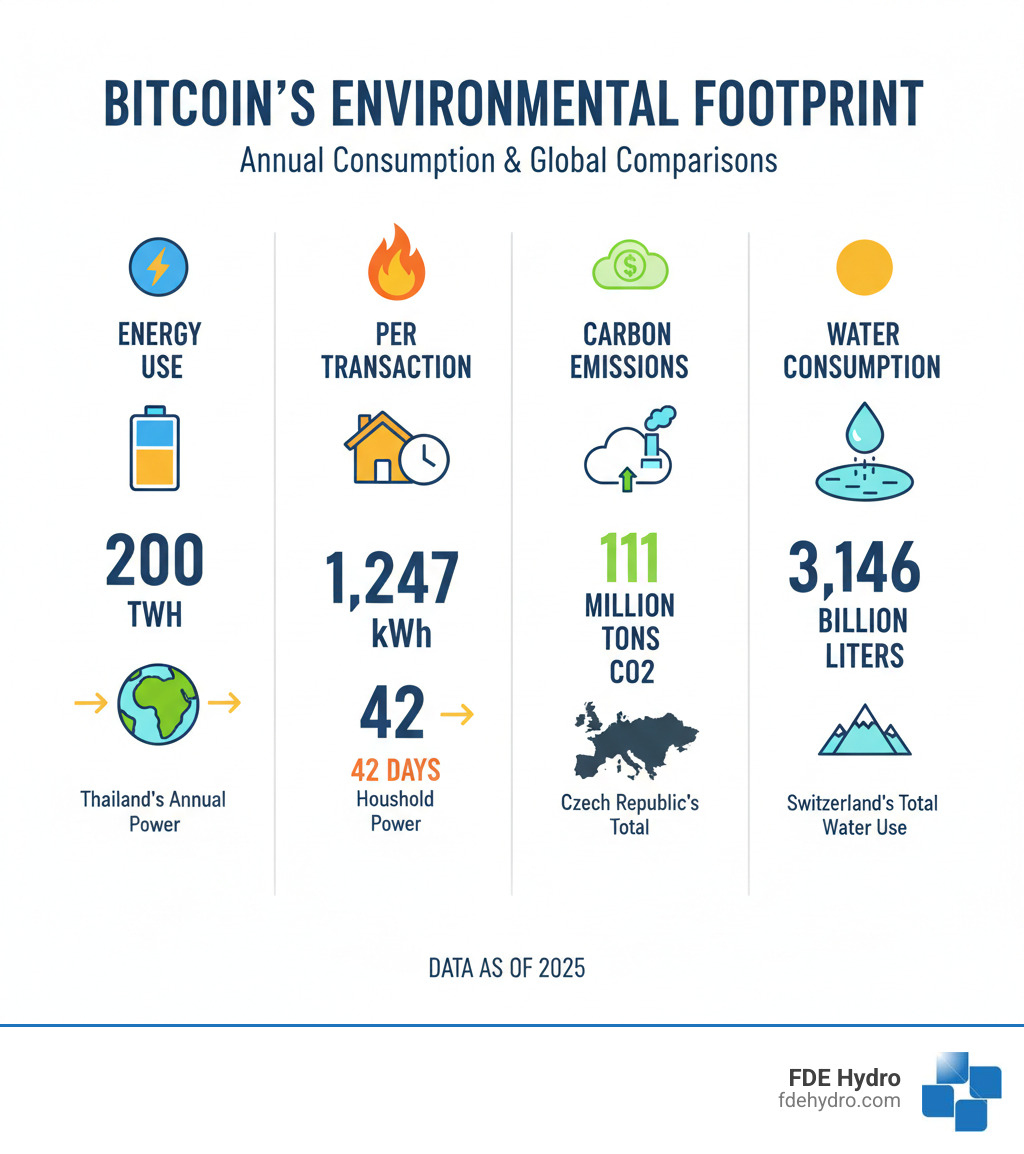

- Annual Energy Use: Bitcoin alone consumes approximately 150-200 TWh of electricity per year—comparable to entire countries like Thailand or Poland.

- Per Transaction: A single Bitcoin transaction uses roughly 1,247 kWh, enough to power an average U.S. household for over 42 days.

- Carbon Footprint: The Bitcoin network generates an estimated 90-111 million tons of CO2 annually, similar to the Czech Republic’s total emissions.

- Water Consumption: Bitcoin mining uses approximately 3,146 billion liters of water per year for cooling and electricity generation.

- Growth Trend: Since the April 2024 halving event, the energy required to mine one Bitcoin has doubled from 407,000 kWh to 850,000 kWh.

One Bitcoin transaction carries the same carbon footprint as 1.5 million VISA transactions. As cryptocurrency adoption grows, so does the strain on electrical grids. In the United States, crypto mining now accounts for an estimated 0.6% to 2.3% of total electricity consumption—enough to power 3 to 6 million homes.

This massive demand creates an infrastructure challenge, affecting grid reliability and electricity prices. Policymakers from Texas to Kazakhstan are struggling to manage this growth without compromising power systems or climate goals.

The true environmental impact of crypto mining power consumption depends on factors like miner location, local power grid carbon intensity, and operational flexibility. Some miners use stranded renewable energy, while others rely on coal-heavy grids.

As Bill French Sr., Founder and CEO of FDE Hydro™, I’ve spent decades in energy infrastructure and was selected by the Department of Energy to help define next-generation hydropower. Understanding crypto mining power consumption is essential for developing the renewable energy systems needed to support our growing computational demands.

The Engine of Bitcoin: Why Proof of Work is So Power-Hungry

Bitcoin’s massive energy use stems from its Proof of Work (PoW) consensus mechanism. In this global, 24/7 competition, powerful computers race to solve complex mathematical puzzles. The winner adds the next block of transactions to the blockchain and earns a Bitcoin reward.

This computational race is what makes crypto mining power consumption so enormous. The computers perform “hashing”—repeatedly guessing a random number until they find the correct one.

The Bitcoin network automatically adjusts puzzle difficulty every two weeks to maintain a 10-minute average block time. As more powerful miners join, the puzzles get harder, creating an arms race for computational power. This system ensures security and decentralization at a high energy cost, as more competition means more electricity consumption.

The Soaring Energy Cost Per Coin

The electricity needed to mine one Bitcoin fluctuates with mining competition, which is heavily influenced by halving events. These events, occurring roughly every four years, cut the mining reward in half. The April 20, 2024, halving dropped the reward from 6.25 to 3.125 Bitcoin per block.

Consequently, the energy required to mine one Bitcoin jumped from about 407,000 kWh to 850,000 kWh, and the cost leaped from roughly $42,656 to $89,095.

This dynamic drives miners to use specialized hardware called ASICs (Application-Specific Integrated Circuits). While designed for efficiency, these machines consume huge amounts of power 24/7. Each new generation of ASICs pushes crypto mining power consumption higher as miners compete to remain profitable, as detailed in a recent study.

A Single Transaction’s Shocking Footprint

A single Bitcoin transaction uses approximately 1,247 kWh of electricity—enough to power an average U.S. home for over 42 days. Each transaction also generates about 696 kilograms of CO2, equivalent to the emissions from 1.5 million VISA transactions.

The difference stems from scalability limitations. The Bitcoin network is limited to about 7 transactions per second, whereas traditional systems like Visa process thousands. Visa’s entire global operation in 2019 used a fraction of Bitcoin’s energy while processing vastly more transactions.

Bitcoin’s block size limit and 10-minute confirmation time create a bottleneck. During network congestion, the energy cost per transaction soars, as the same massive power usage validates fewer transactions.

This is Bitcoin’s paradox: its security comes at a growing environmental cost. Understanding these dynamics is crucial for the future of digital finance and energy infrastructure.

Sizing Up the Footprint: Bitcoin’s Global Environmental Impact

The environmental impact of crypto mining power consumption goes beyond electricity bills to include carbon emissions, water use, and electronic waste. The true cost of Bitcoin extends far beyond the power meter.

The Scale of Crypto Mining Power Consumption

Bitcoin’s annual electricity consumption is around 199.63 TWh, more than nations like Finland and similar to Poland. This dedicates an entire country’s worth of power to a single digital currency network.

In the U.S., crypto mining consumes 0.6% to 2.3% of total electricity, enough for three to six million homes. In Canada, the world’s fourth-largest mining hub, operations have used about 4,048 gigawatt hours since early 2024, representing a 6.48% share of global production.

This demand challenges power grids in regions like New York, California, and Kansas, especially during peak periods. The Cambridge Bitcoin Electricity Consumption Index tracks these figures, while the International Energy Agency projects that crypto and data centers’ share of world electricity demand will grow from 2% in 2022 to 3.5% by 2026, straining infrastructure.

Beyond Energy: Carbon, Water, and E-Waste

Beyond electricity, the environmental impact is multifaceted. Bitcoin’s carbon footprint is 77 to 111.35 million tonnes of CO2 annually, comparable to the Czech Republic’s total emissions. The impact depends not just on how much energy is used, but its source. Miners on coal-powered grids have a much higher carbon intensity.

Water consumption is another significant factor. Bitcoin mining’s water footprint was around 1.5 billion liters in 2021, with some analyses suggesting 1,650 billion liters from 2020-2021. Bitcoin’s annual fresh water consumption is comparable to Switzerland’s total use—approximately 3,146 billion liters. This demand can strain local ecosystems, as detailed in research on Bitcoin’s water footprint.

Finally, the rapid obsolescence of hardware creates significant e-waste. The race for powerful mining equipment generates about 24.73 kilotonnes of electronic waste annually, similar to the small IT equipment waste of the Netherlands. These specialized rigs contain materials that require proper disposal, adding to the global e-waste problem.

The environmental footprint of crypto mining affects local power grids, water supplies, and waste management systems globally, with impacts that are still being fully measured.

The Challenges of Measuring Crypto Mining Power Consumption

Measuring crypto mining power consumption is remarkably tricky. The decentralized and opaque nature of mining operations makes accurate measurement a persistent challenge. Mining is scattered globally, with no central registry or reporting requirements, forcing researchers to rely on economic modeling and assumptions.

Estimates vary wildly based on assumptions about electricity prices and hardware efficiency, leading to discrepancies of hundreds of TWh. The dynamic nature of the market adds further difficulty. As new ASICs are released and network difficulty increases, the energy landscape constantly shifts. A paper on revisiting Bitcoin’s carbon footprint explores these complexities.

The Problem with Pinpointing Miner Locations

Geographic distribution is constantly shifting, and miners often keep locations private for security, regulatory, and economic reasons. For instance, the U.S. share of Bitcoin mining grew from 3.4% to 37.8% between 2020 and 2022 after China’s crackdown, but precise locations within states like New York or California remain unclear. The Cambridge mining map offers the best available data but has significant gaps.

Underground mining operations further obscure the data. Miner location is critical because it determines the carbon intensity of the electricity used. A farm using hydropower in Quebec has a far lower impact than one using coal in Kazakhstan. This geographic shifting makes tracking the network’s true carbon footprint incredibly challenging.

Why Accurate Estimates Are So Difficult

Even with location data, precise calculation is difficult. The methodology for energy estimation requires assumptions at every step. Researchers start with the public network hashrate but must estimate the hardware used, its efficiency, and electricity costs.

Each variable introduces uncertainty. Hardware efficiency varies widely: a new ASIC might use 30 watts per terahash, while an older model uses 100. Across millions of machines, this creates huge estimate divergences. Self-reported data is often incomplete, as mining companies have little incentive to disclose their full impact.

The constant fluctuation in network hashrate adds a final layer of complexity. As Bitcoin’s price and energy costs change, miners enter and exit the market, meaning crypto mining power consumption is not a static figure. Despite these challenges, researchers continue to refine their models. While perfect accuracy is elusive, current estimates are sufficient to grasp the scale of the problem and the need for sustainable solutions.

The Path to a Greener Ledger: Solutions and Alternatives

The environmental challenges of crypto mining power consumption are significant but not impossible. Progress is being made through cleaner energy, smarter operations, and better regulations. The solutions must be as innovative as the technology itself.

Tapping into Renewable Resources

Encouragingly, nearly 50% of Bitcoin mining already uses clean energy. Hydropower leads at 23.12%, followed by wind (13.98%), solar (4.98%), and other renewables (2.40%). This is where companies like FDE Hydro™ can make a difference by providing reliable, clean hydropower infrastructure.

However, challenges remain. The intermittent nature of solar and wind power clashes with the 24/7 demand of mining. When renewables are unavailable, miners may switch to fossil fuels, straining grids.

This challenge presents a unique opportunity. Miners are flexible electricity consumers who can act as “buyers of first resort” for new renewable projects, making them financially viable. They can also be “buyers of last resort” for surplus renewable power that the grid cannot absorb. Miners are increasingly locating near stranded energy assets, like underused power plants or flared methane gas, which helps balance grids and reduce emissions. Hydropower is crucial here, offering the reliability and dispatchability that wind and solar lack. This is why hydropower’s role in the energy grid is so critical for supporting modern computational demands. More details can be found in this research on renewable energy use in mining.

Industry-Led Initiatives for Sustainability

The crypto industry is also developing initiatives to reduce its footprint, from carbon mitigation to grid management. Carbon offsetting through credits or sequestration projects is a common practice. While sometimes criticized, verified offsetting projects can reduce net emissions during the transition to cleaner energy.

More promising is the growth of demand-response programs. Miners in Texas, New York, and California voluntarily reduce power use during peak demand, which is smart grid management. This helps prevent the use of carbon-intensive “peaker” plants and can avoid millions of tons of CO2 emissions.

Government regulations are also evolving, with incentives for renewables, carbon taxes, and greater transparency requirements to accelerate the transition to cleaner mining.

At FDE Hydro™, we believe the future of sustainable crypto mining power consumption combines clean energy infrastructure with smart operations. Our work on innovations in hydropower focuses on making reliable renewable energy more accessible, which is essential for powering the next generation of digital infrastructure responsibly.

Frequently Asked Questions about Crypto’s Environmental Impact

How does Bitcoin’s environmental impact compare to traditional resource extraction?

The term “digital gold” invites a comparison between the environmental impacts of Bitcoin and traditional gold mining. Traditional gold mining is a physical process involving heavy machinery, diesel fuel, and chemical extraction. The industry produces about 81 million metric tonnes of CO2 annually.

Bitcoin mining avoids direct land destruction, but its impact is still severe. Mining a single Bitcoin generates an estimated 678 tonnes of CO2, whereas mining the equivalent value in physical gold produces about 42 tonnes of CO2. Bitcoin’s carbon intensity per unit of value is currently far higher.

The impacts differ: gold mining causes direct land disruption and pollution, while Bitcoin’s impact stems from crypto mining power consumption, emissions, water use, and e-waste. Both are environmentally costly, as shown in data on resource extraction emissions.

Why is the Bitcoin network so slow if it uses so much power?

It’s a common question: if Bitcoin uses so much power, why isn’t it fast? The energy isn’t for speed; it’s for security and decentralization—Bitcoin’s original design goals.

Bitcoin is intentionally designed to add a new block every 10 minutes and process only about 7 transactions per second. This deliberate slowness, a result of the energy-intensive Proof of Work mechanism, is a trade-off that ensures the network is incredibly resistant to tampering and centralized control. Security and decentralization are prioritized over speed and scalability.

What are the future projections for crypto mining power consumption?

Predicting future crypto mining power consumption is complex, but several key forces will shape its trajectory.

- Future halving events will continue to force out inefficient miners and drive investment in more efficient hardware, though network difficulty adjustments often offset these gains.

- Hardware efficiency improvements are ongoing but approaching physical limits, meaning technology alone isn’t the solution.

- Competition from AI is creating a major new demand for energy. AI data centers may soon consume more power than Bitcoin mining, straining grids and increasing electricity costs.

- Regulatory pressures like carbon taxes and incentives for renewables will likely make fossil-fuel-powered mining economically unviable.

- Alternative consensus mechanisms like Proof of Stake (PoS) offer a path forward. Ethereum’s move to PoS cut its energy use by over 99.85%, proving less energy-intensive models are viable.

At FDE Hydro™, we believe the future requires a mix of solutions, including greater adoption of renewable energy sources like hydropower and continued innovation in both blockchain technology and clean energy infrastructure.

Conclusion: Powering the Future of Digital Finance Sustainably

As we’ve seen, crypto mining power consumption is a major global issue, with Bitcoin’s energy use rivaling that of entire countries. The network’s impact includes massive electricity use per transaction, significant carbon emissions, water strain, and growing electronic waste, affecting communities worldwide.

However, the story isn’t entirely negative. Nearly half of Bitcoin mining now uses renewable energy, and miners are helping balance power grids. Alternatives like Proof of Stake demonstrate that low-energy cryptocurrencies are possible, with Ethereum cutting its consumption by over 99%.

The path forward requires reliable, clean, 24/7 power. This is where hydropower excels. At FDE Hydro™, our patented modular technology makes building and retrofitting hydroelectric dams faster and more cost-effective. We deliver stable, emissions-free energy in North America, Brazil, and Europe to support both traditional and emerging computational demands.

Water is one of Earth’s most dependable renewable resources, offering the consistency that intermittent sources like wind and solar cannot always provide. Investing in proven, modern hydropower is key to ensuring digital finance can evolve without compromising our planet’s future.

The crypto industry must evolve sustainably. The tools—clean energy, grid integration, efficient hardware, and new consensus mechanisms—already exist. At FDE Hydro™, we are committed to being part of the solution. We believe digital innovation and environmental responsibility can coexist. By using water’s power through modern hydropower, we can help build a sustainable energy future. To learn more about how hydropower is shaping this future, explore the value of hydropower.

The question isn’t if we can power digital finance sustainably, but if we will.