Why the Global Hydropower Market Matters for the Energy Transition

The global hydropower market is the world’s largest source of renewable electricity, supplying 14.3% of global power across 150 countries. Valued between USD 109-257 billion in 2024, the sector is projected to reach USD 184-280 billion by 2030-2032. Despite this growth, development has slowed, even as the world must double its hydropower capacity by 2050 to meet net-zero targets.

Key Market Facts at a Glance:

- Global Capacity: 1,253-1,412 GW installed (2024)

- Annual Growth: 15.1-24.6 GW added in 2024

- Market Leaders: Asia-Pacific (37-40% share), China dominates with 377+ GW

- Investment Need: USD 130 billion annually required to meet climate goals

- Storage Potential: Pumped storage provides over 90% of global energy storage

- Untapped Potential: Roughly 50% of economically viable hydropower remains undeveloped

Hydropower is more than a power source; it’s the backbone of grid stability. Its ability to ramp up and down rapidly is essential for balancing intermittent renewables like solar and wind. However, the industry faces headwinds: aging infrastructure (average plant age is 45-50 years in developed markets), high upfront costs, long development timelines, and environmental concerns. The solution lies in modernizing existing facilities, expanding pumped storage, and adopting innovative construction methods.

I’m Bill French Sr., Founder and CEO of FDE Hydro™, and for over five decades I’ve worked in heavy civil construction before pioneering modular solutions for the global hydropower market through our patented French Dam technology. Our mission is to address the industry’s most pressing challenges—excessive costs and timelines—by delivering innovative, environmentally-conscious construction methods that make hydropower development more accessible and sustainable.

Global hydropower market terms to know:

Global Hydropower Market Dynamics: Size, Growth, and Projections

The global hydropower market is a powerhouse in the renewable energy landscape. Market valuations for 2024 range from USD 109 billion to USD 257 billion, with a clear growth trajectory toward USD 184-280 billion by the early 2030s. Projected growth rates vary from 1.5% to 6.84% CAGR, reflecting different scenarios for policy support and technological advancement.

In 2024, the world added 15.1-24.6 GW of new capacity, bringing the total installed capacity to 1,253-1,412 GW. Hydropower continues to supply 14.3% of the world’s electricity, making it the largest single source of renewable power. It is the workhorse that enables the integration of variable renewables like solar and wind.

However, a critical investment gap exists. To meet climate targets and double capacity by 2050, the sector requires approximately USD 130 billion annually—more than double current levels. This funding shortfall highlights the need for construction innovations that reduce costs and timelines, making every dollar go further. More info about renewable energy projects.

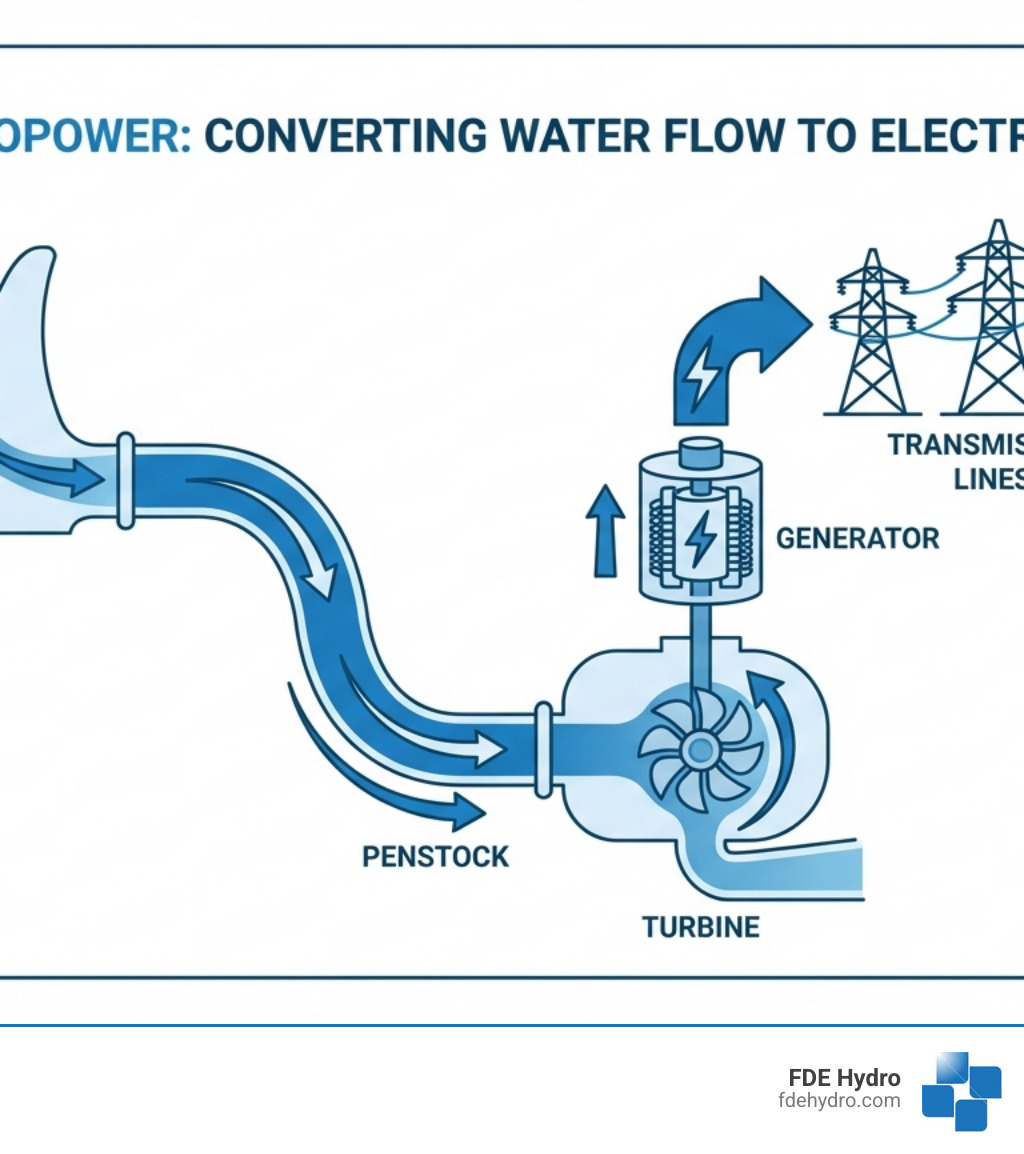

Component and Capacity Segmentation

Breaking down the global hydropower market, the civil construction segment (dams, tunnels, etc.) is dominant, accounting for over 33.24% of revenue in 2024. This is followed by electromechanical equipment (turbines, generators) and power infrastructure. The high cost of civil construction is often the primary hurdle for new projects.

In terms of capacity, large and medium hydropower projects (>100 MW) make up over 70% of the market, providing essential baseload power and grid stability. However, the fastest growth is in small, micro, and pico hydropower systems. Projected to grow at 5.37% annually, these smaller installations offer lower environmental impact, faster deployment, and can power remote communities. This proves hydropower is a scalable and adaptable solution.

Our modular precast concrete technology directly addresses the high costs of civil construction, making it a viable solution across all capacity ranges. More info about hydroelectric dam components.

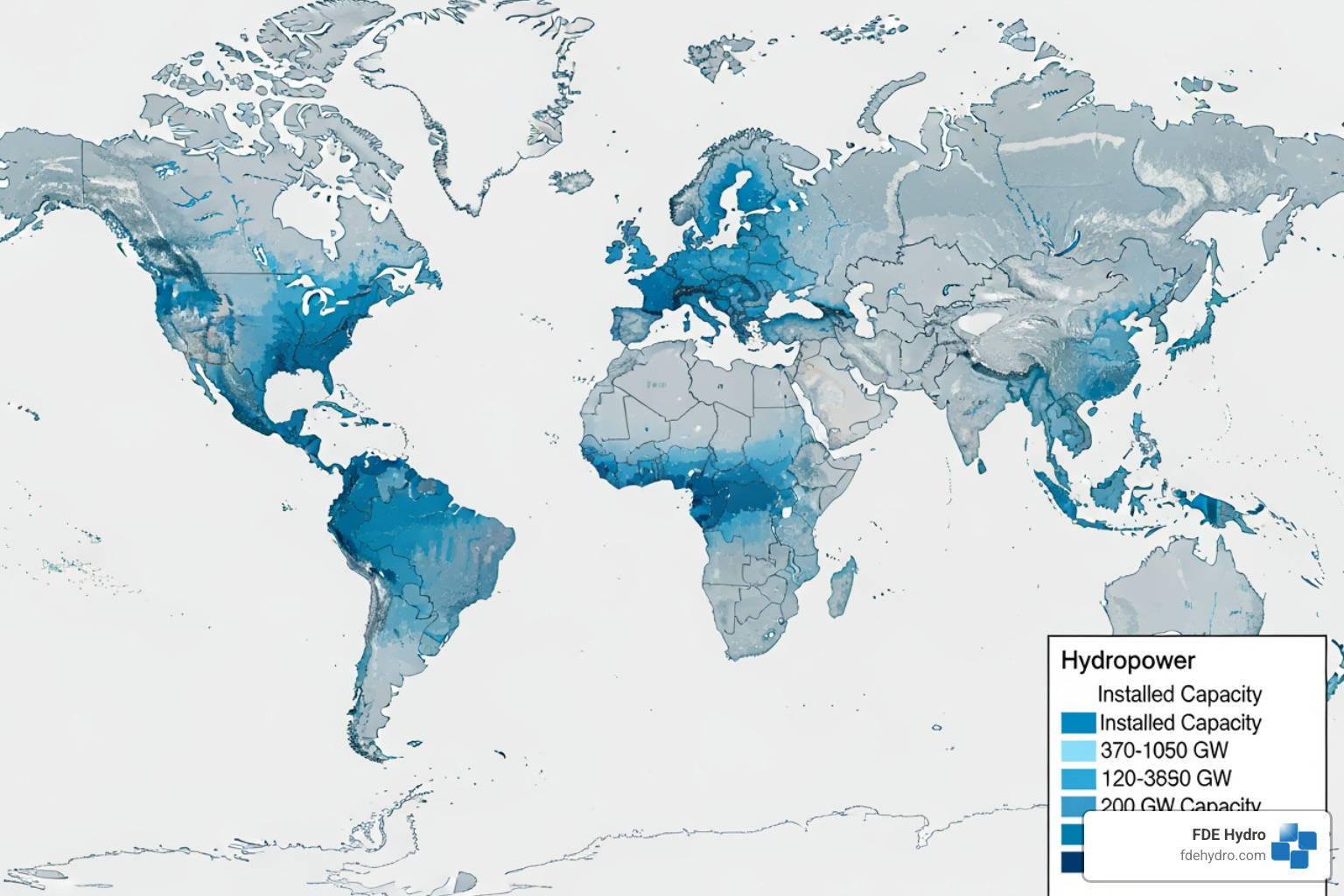

Regional Analysis of the Global Hydropower Market

The global hydropower market varies significantly by region. While Asia-Pacific leads in new capacity, major opportunities for modernization exist in North America, Europe, and Brazil—key focus areas for FDE Hydro™.

Europe held a 27.67% revenue share in 2024 with nearly 259 GW of capacity. The critical issue is its aging fleet, with an average facility age of 45 years. Modernization is expected to comprise 90% of hydropower investment this decade, driven by the EU’s goal of 42.5% renewable energy by 2030.

North America faces a similar situation, with average plant ages near 50 years. The U.S. has 80.92 GW of capacity, and the Department of Energy is actively supporting upgrades. With 360 GW of untapped potential and half of the non-federal fleet facing relicensing by 2035, the region is a modernization goldmine. More info about hydropower construction in North America.

Brazil and Latin America are highly dependent on hydropower, which supplies 45% of the region’s electricity. Brazil leads with over 109.9 GW of installed capacity. While new growth is modest, the vast existing infrastructure (176 GW in South America) offers immense potential for optimization and modernization. These regions all require faster, cost-effective construction methods, where modular approaches can make a significant impact.

The Engine of Growth: Technology, Modernization, and Investment

The global hydropower market is evolving rapidly, driven by technological breakthroughs. Advancements include more efficient turbines, advanced materials, and optimized run-of-river systems. Small-scale modular hydropower systems are also gaining traction, offering flexible deployment in locations unsuitable for large dams.

Digitalization is revolutionizing plant operations. Using AI, IoT, and data analytics, modern facilities can self-monitor, predict maintenance needs, and optimize efficiency in real-time. Digital twin technology enables operators to run virtual simulations for testing and troubleshooting. Other key innovations include free-flow turbines for low-current rivers and variable-speed turbines that adapt to water flow.

The rise of hybrid systems that integrate hydropower with solar and wind is particularly promising. This strategic pairing leverages hydropower’s core strength: flexibility. Hydropower can ramp up instantly to fill gaps when solar or wind generation drops, creating a stable and reliable clean energy grid.

More info about hydropower advancements and innovations.

The Rise of Pumped Storage and Modernization

Two forces are reshaping the global hydropower market: the growth of pumped storage hydropower (PSH) and the urgent need for modernization.

PSH acts as the world’s largest “rechargeable water battery.” It uses cheap, off-peak electricity to pump water to an upper reservoir and releases it to generate power during peak demand. PSH facilities store approximately 9,000 GWh of energy, over 90% of the world’s total energy storage. With 8.4 GW of new PSH capacity added in 2024 and 600 GW in the global pipeline, it is indispensable for balancing intermittent renewables.

Simultaneously, much of the existing hydropower fleet is aging. In North America and Europe, the average plant is 45-50 years old. By 2030, over 20% of the global fleet’s generating units will be older than 55 years, requiring major replacement. This presents a massive opportunity for modernization. Retrofitting older plants with new technology can boost efficiency, extend life, and improve environmental performance.

The required investment is significant: an estimated USD 127 billion is needed for modernization by 2030, with a total need of USD 300 billion to upgrade all aging plants. In North America and Europe, modernization will account for nearly 90% of hydropower investment this decade. Our modular construction methods at FDE Hydro™ make these retrofits faster and more affordable, helping to close the investment gap.

More info about Pumped Storage Hydropower.

Strategic Developments and Industry Progress

Progress in the semi-consolidated global hydropower market relies on collaboration between public agencies, private companies, and governments.

Modernization contracts are now central to development in mature markets like North America and Europe, focusing on upgrading aging plants to improve efficiency and extend lifespans. Public-private partnerships are essential for funding these large-scale projects. Government support, such as incentives from the U.S. Department of Energy and the EU’s renewable energy targets, is crucial for reducing financial risk and encouraging private investment. Regulatory frameworks that compensate hydropower for its grid stability services are also improving the investment climate.

While the industry expands globally, FDE Hydro™ focuses on North America, Brazil, and Europe, where our modular construction methods can have the greatest impact. Our patented French Dam technology directly addresses the industry’s primary obstacles: excessive costs and lengthy timelines. By delivering projects faster and more affordably, we help attract private investment and ensure hydropower’s long-term viability. Success requires a combination of innovation and local expertise to steer regional geology, regulations, and community needs.

Read about FDE Hydro’s approach to modernization and project delivery.

Navigating Headwinds: Challenges and Opportunities in the Hydropower Sector

The global hydropower market faces significant challenges that demand innovative solutions. Each challenge, however, presents an opportunity for growth.

Key headwinds include:

- High Upfront Capital Costs: New projects require substantial investment, with 2022 costs ranging from USD 6,574/kW to USD 8,611/kW.

- Long Development Timelines: Complex permitting and lengthy construction schedules can deter investors.

- Environmental and Social Impacts: Large-scale projects can disrupt ecosystems, fish migration, and local communities, requiring careful environmental assessments and public engagement.

- Climate Change Risks: Hydropower is vulnerable to climate change effects like droughts and floods, which create uncertainty in water availability and power generation.

| Metric | Hydropower | Solar PV | Wind | Natural Gas |

|---|---|---|---|---|

| LCOE (USD/MWh) | 47-84 | 26-50 | 24-75 | 44-73 |

| Capacity Factor | 30-70% | 10-25% | 25-45% | 50-60% |

| Grid Services | Excellent (rapid ramp, storage) | Limited | Limited | Good |

| Land Use (m²/MWh/year) | Low (reservoir varies) | High | Moderate | Low |

Overcoming Barriers and Seizing Opportunities in the Global Hydropower Market

Despite these challenges, the global hydropower market is filled with opportunity. With the right innovation and policies, hydropower can serve as the “guardian of the grid.”

Globally, about half of hydropower’s economically viable potential is undeveloped. The technically feasible potential is a staggering 16,000 TWh per year, with less than a third currently exploited. Regions like North America, Brazil, and Europe offer significant room for growth.

Government policies and incentives are key to open uping this potential. Support from the U.S. Department of Energy (DOE) and the EU’s renewable energy targets are driving investment in modernization and pumped storage. These policies recognize hydropower as the backbone that enables other renewables.

Read the U.S. Hydropower Market Report.

Hydropower’s greatest strength is providing grid stability services. Its ability to ramp generation up and down rapidly is essential for balancing variable renewables. Hydropower accounts for nearly 30% of the world’s flexible electricity supply. As markets evolve to better compensate for this flexibility, the business case for hydro strengthens. Additionally, projects provide public benefits like flood control, irrigation, and water supply that add value beyond electricity generation.

At FDE Hydro™, our mission is to tackle development barriers directly. Our patented French Dam modular technology reduces construction costs and timelines, making projects more financially attractive and faster to complete. This approach helps overcome traditional problems, delivering clean, reliable hydropower sooner.

More info about why hydropower is the guardian of the grid.

Frequently Asked Questions about the Global Hydropower Market

Here are answers to common questions about the global hydropower market and its role in the energy transition.

What is the projected growth of the global hydropower market?

The global hydropower market is projected to grow steadily, with forecasts ranging from 1.5% to 6.84% CAGR. This will increase its market valuation from a 2024 range of USD 109-257 billion to USD 184-280 billion by the early 2030s. This growth is driven by the global push for clean energy and the increasing need for hydropower’s grid stability services to support intermittent renewables like solar and wind.

Why is hydropower considered a crucial renewable energy source?

Hydropower is the world’s largest source of renewable electricity, supplying 14.3% of global power. Its crucial role stems from its unique combination of reliability and flexibility. It provides reliable, baseload power and can ramp generation up or down in minutes to balance the grid. Furthermore, pumped storage hydropower (PSH) offers massive energy storage capacity—over 9,000 GWh globally, or 90% of the world’s total. This storage is indispensable for integrating high levels of intermittent renewables into a stable grid.

What are the main challenges facing hydropower development?

The main challenges facing the global hydropower market are:

- High Initial Investment Costs: New projects require significant capital, with costs ranging from USD 6,574/kW to USD 8,611/kW.

- Long Development Timelines: Complex permitting and construction processes can take years, increasing financial risk.

- Environmental and Social Impacts: Large dams can disrupt ecosystems and communities, necessitating thorough environmental assessments and stakeholder engagement.

- Climate Change Variability: Altered precipitation patterns, including droughts and floods, create uncertainty in water availability and power generation.

These challenges drive the need for innovative solutions, like the modular construction methods developed by FDE Hydro™, which reduce costs and timelines, making projects more economically viable.

Conclusion

The global hydropower market is at a critical juncture for the energy transition. It is the backbone of a renewable grid, providing the reliable, flexible power and large-scale storage that enables the growth of solar and wind.

The future lies not only in new construction but in modernizing the existing fleet. Thousands of aging plants in North America and Europe require upgrades, representing a USD 127 billion investment opportunity by 2030. Overcoming barriers like high costs, long timelines, and environmental concerns is essential. This requires supportive policies and, most importantly, technological innovation.

This is the core mission of FDE Hydro™. Our patented French Dam technology uses modular precast concrete to directly attack the industry’s biggest challenges: excessive costs and lengthy timelines. By making hydropower development and retrofitting faster, more affordable, and sustainable, we can open up the 50% of economically viable potential that remains untapped. The energy transition needs hydropower, and hydropower needs innovation. We are ready to deliver.

Learn how advanced encapsulation technologies are reinvigorating aging hydropower infrastructure.