Understanding the Dual Nature of Massive I/P Portfolios

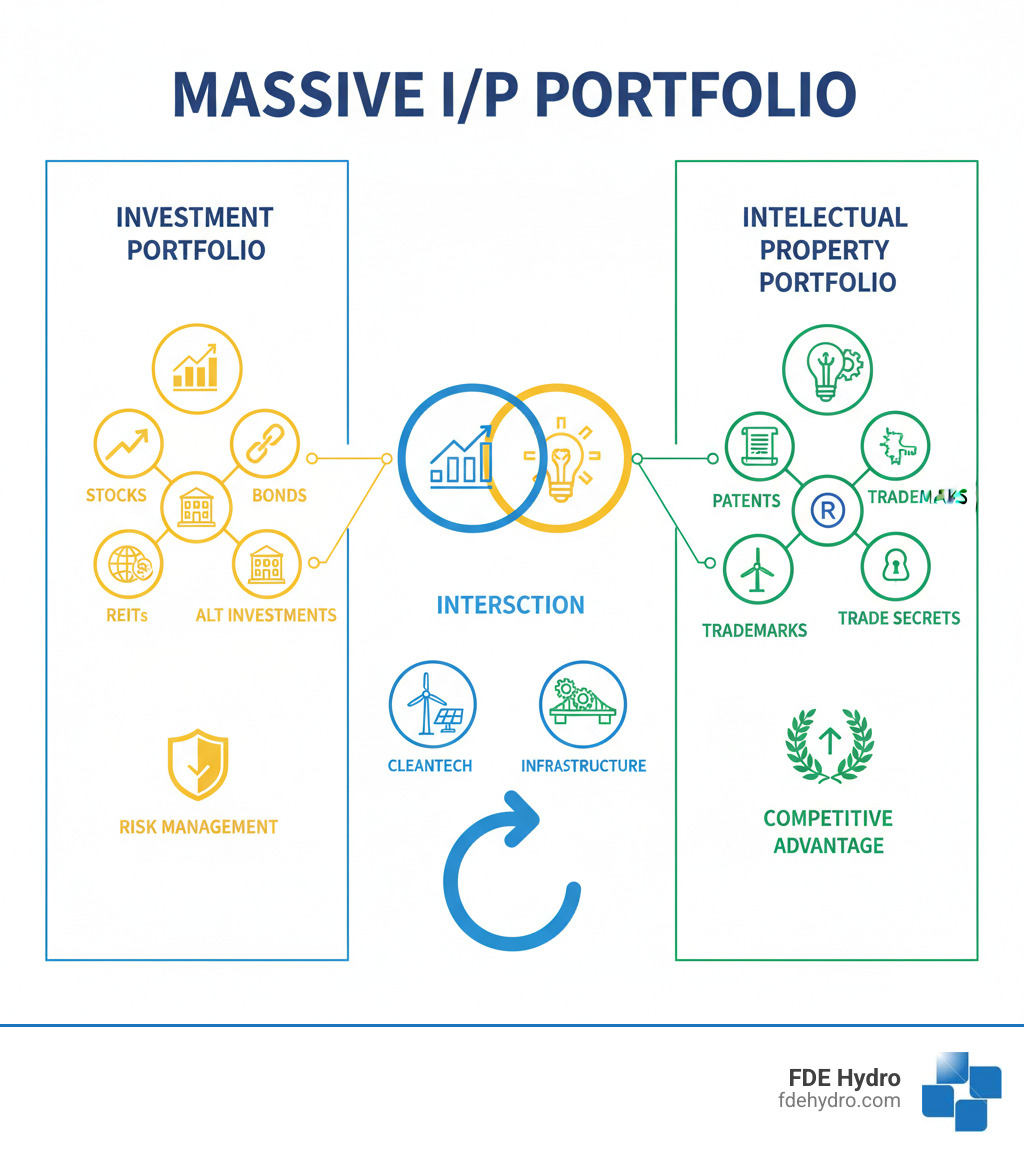

Massive I/P Portfolio can mean two very different things depending on your industry. For investors, it refers to a large-scale collection of financial assets designed to generate wealth through strategic diversification. For innovators and corporations, it means a substantial collection of intellectual property—patents, trademarks, and proprietary technologies—that create competitive advantage and market exclusivity.

Quick Answer: What is a Massive I/P Portfolio?

- Investment Portfolio: A large, diversified collection of stocks, bonds, and alternative assets designed to maximize returns while managing risk.

- Intellectual Property Portfolio: A substantial collection of patents, trademarks, and copyrights that protect innovation and create market barriers.

- Strategic Value: Both serve as foundational assets—one builds financial wealth, the other protects and monetizes innovation.

- Intersection: Companies with strong IP portfolios often attract significant investment, especially in sectors like renewable energy and cleantech.

The confusion between these two meanings is understandable. Both represent massive collections of valuable assets, require strategic management, and have long-term vision. Increasingly, they intersect in the modern economy—particularly in capital-intensive sectors where innovation drives competitive advantage.

For infrastructure projects—especially in renewable energy—both types of I/P portfolios play crucial roles. A well-diversified investment portfolio provides the capital needed for development, while a robust intellectual property portfolio protects the innovations that make projects viable and cost-effective.

I’m Bill French Sr., Founder and CEO of FDE Hydro(TM). We’ve built both types of Massive I/P Portfolios—securing patents for our modular hydropower construction across the US, Canada, Europe, and Brazil, while mastering the investment strategies that fund large-scale infrastructure. My experience in civil construction and hydropower has shown me how these two portfolio types intersect to create lasting value.

What is a Massive I/P Portfolio?

The term Massive I/P Portfolio creates an interesting puzzle. Those two letters—I/P—can open up two completely different meanings, depending on whether you’re sitting in a boardroom reviewing quarterly earnings or in a lab protecting your latest breakthrough. Both interpretations represent substantial collections of valuable assets that require strategic thinking and play essential roles in building competitive advantage.

Understanding the Massive I/P Portfolio as a Financial Strategy

When discussing investment portfolios, “massive” implies more than just owning many different stocks. A Massive I/P Portfolio from the financial side is a large-scale, strategically diversified collection of assets designed to optimize returns while managing risk. It’s like building a financial fortress where each asset class helps protect and grow your wealth.

Conventional wisdom on diversification is often oversimplified. While early research suggested 32 stocks could eliminate most risk, recent studies show even a portfolio of 60 stocks captures only 86% of the diversification available in the market. The reality is stark: 39% of stocks are unprofitable over their lifetimes, 64% underperform their benchmark, and just 25% of stocks are responsible for all market gains. This highlights why a massive portfolio requires genuine strategy, not just quantity.

Your personal risk tolerance is the foundation of any portfolio strategy. The SEC offers helpful guidance on Assessing Your Risk Tolerance, as understanding your emotional comfort with volatility is as crucial as the math behind asset allocation. Without this alignment, you’ll struggle to maintain your strategy during market downturns.

Understanding the Massive I/P Portfolio as an Innovation Asset

On the innovation side, a Massive I/P Portfolio is your company’s arsenal of patents, trademarks, copyrights, and trade secrets. This collection creates a defensive moat—a barrier protecting your innovations from competitors and securing your exclusive market position.

This isn’t just about hoarding patents; it’s about creating freedom to operate. A strong IP portfolio allows you to commercialize and license your technology without fear of infringement claims, giving you control over your innovation destiny.

Take NASA, whose extensive NASA IP Portfolio shows how a massive IP collection can drive development and commercialization across industries. They actively encourage others to build on their work through strategic licensing.

IP Group is another case study, managing IP portfolios across Deeptech, Life Sciences, and Cleantech. Their holdings, from 5G solutions to oncology therapies, show how a well-constructed IP portfolio creates value across multiple cutting-edge industries.

Patent brokerage firms like ICAP Patent Brokerage actively commercialize high-value patent portfolios. These are not dusty documents but actively traded, licensed, and monetized assets that generate real revenue.

The scale of an IP portfolio matters. Just as financial diversification protects against market volatility, a broad IP portfolio protects against technological and competitive threats. Whether in renewable energy or medical devices, your IP portfolio is the foundation of your long-term market position.

Building a Massive Investment Portfolio: Strategies and Components

Building a Massive Investment Portfolio is like constructing a dam—it requires the right materials, solid engineering, and a design that can withstand any storm. We’re not just piling up assets; we’re creating a structure that protects wealth while generating long-term returns.

Core Asset Classes and Diversification

Every strong portfolio starts with fundamentals. Stocks offer ownership and growth potential, though with volatility. Bonds are loans to governments or corporations, providing steadier, regular interest. Alternative assets like real estate, commodities, and private equity often move independently from stocks and bonds, making them valuable for diversification.

True diversification means spreading investments across thousands of stocks, multiple sectors, and different countries. Since even 60 stocks only capture 86% of true market diversification, low-cost index funds and ETFs have become the practical way for most to achieve it.

Within alternatives, Real Estate Investment Trusts (REITs) are popular for income. The SEC’s Investor Bulletin: Publicly Traded REITs explains how they pass earnings to shareholders. Master Limited Partnerships (MLPs), detailed in the Updated Investor Bulletin: Master Limited Partnerships – An Introduction, often focus on energy infrastructure and provide steady income. Understanding the Dividend Yield of holdings helps evaluate returns, while focusing on fundamental Value is key for long-term investments like renewable energy projects.

Comparing Portfolio Types

Portfolios are built around objectives and risk tolerance.

- Aggressive portfolios chase maximum growth with higher risk, focusing on early-stage tech, high-Beta stocks, and emerging markets. This suits investors with a long time horizon.

- Defensive portfolios prioritize capital preservation, favoring consumer staples, utilities, and high-quality bonds. These “Rainy Day Stocks” offer stability during downturns.

- Income portfolios focus on generating cash flow through dividend stocks, REITs, and MLPs, ideal for those needing regular income.

- Speculative portfolios chase outsized returns via IPOs and leveraged ETFs. Most advisors suggest limiting these to 10% or less of a total portfolio.

- Hybrid portfolios blend approaches, mixing stocks, bonds, and real estate to balance growth with stability, like the classic 60/40 portfolio.

The Rise of Alternative and Thematic Strategies

Modern portfolio construction has evolved beyond simple stock-and-bond splits. Sophisticated investors now use alternative strategies that seek uncorrelated bets—investments that don’t all move in the same direction.

For example, “The Fortress Portfolio” uses layered, uncorrelated investments for wealth preservation. It achieved a Sortino ratio of 1.78 (vs. 0.90 for a 40/60 portfolio), indicating better risk-adjusted returns by focusing on downside volatility. The “SPY Hunter Portfolio” aims to beat the S&P 500 with better downside protection by shifting between offensive and defensive modes using managed futures, gold, and other strategies. Understanding topics like Energy 101 is important here, especially for thematic investments in renewables.

These modern approaches show that true portfolio strength comes from combining assets that react differently to market conditions. This principle of diversification for reliability is one we apply at FDE Hydro(TM) when designing hydropower systems. The fundamentals of smart design, diversification, and long-term thinking apply to both financial assets and infrastructure projects.

The Strategic Value of an Intellectual Property Portfolio

Just as a diversified investment portfolio protects financial wealth, a robust intellectual property portfolio protects a company’s innovations. For us at FDE Hydro(TM), our Massive I/P Portfolio isn’t just a collection of legal documents—it’s the foundation of our competitive position in the renewable energy sector.

IP as a Defensive Moat and Competitive Advantage

Think of intellectual property as the castle walls protecting your kingdom of innovation. Patents grant exclusive rights to inventions, preventing others from making, using, or selling them. This exclusivity creates a powerful defensive moat—a barrier that competitors can’t easily cross.

This allows us to secure market share and command premium pricing. As the Innovation Asset Collective demonstrates by acquiring patents to give members a business advantage, a Massive I/P Portfolio functions as both a shield and a sword.

Our patented modular precast concrete technology—the “French Dam”—exemplifies this. We’ve secured patent protection across the US, Canada, Europe, and Brazil, giving us freedom to operate in major markets. This protection extends to innovations like Dam Rehabilitation Encapsulation, ensuring our methods remain unique. Competitors face a wall of patents, forcing them to either license from us or develop entirely different, and likely more expensive, approaches.

Strong IP protection also gives us the confidence to invest heavily in R&D, knowing our innovations won’t be copied. You can learn more About Us and how we’ve built this protective moat around our hydropower innovations.

Commercialization and Attracting Investment

A Massive I/P Portfolio does more than defend—it generates value. Licensing agreements allow us to monetize our patents by granting other companies rights to use our technology in exchange for royalties, creating ongoing revenue while expanding our innovations’ reach.

More importantly, strong IP acts as a magnet for investment capital. Venture capital and private equity firms scrutinize IP portfolios because patents represent tangible, protected value. In capital-intensive sectors like cleantech, a robust patent portfolio often makes the difference in securing funding.

Our patents can also serve as collateral for IP-backed financing, making it easier to secure loans. Investors view protected technology as a real, quantifiable asset, similar to physical property.

We’ve learned that Financing Long-Term Hydropower Requires Mitigating Risks Prior to ROI. Our Massive I/P Portfolio directly addresses this by proving our technology is unique, protected, and defensible. When investors see our patents, they understand we’re an innovation company with protected competitive advantages.

This combination of defense and commercial potential transforms IP from a legal necessity into a strategic business asset. For companies in the renewable energy space, a strong IP portfolio is essential for survival and growth.

The Intersection: Where Investment Meets Innovation

The real magic happens when financial strategy meets technological innovation. This is where smart money finds breakthrough ideas, and where groundbreaking inventions secure the funding they need to change the world. In sectors like Deeptech, Cleantech, and infrastructure, this intersection is essential.

Investing in Companies with Strong IP

When evaluating potential investments, a company’s intellectual property strength reveals much about its future. Companies with robust patent portfolios are building walls that keep competitors at bay, creating market positions that can last for years.

Smart investors look beyond financial statements. In innovation-driven sectors, the key question is about the ownership and defensibility of proprietary technology. A strong Massive I/P Portfolio can be more valuable than current earnings, as it can open up entirely new markets.

IP Group demonstrates this approach, with a portfolio spanning companies in advanced AI, novel therapies, and next-gen battery technology. These are calculated investments in companies where patented technology creates genuine competitive advantages.

In the renewable energy space, this principle is even more critical. We’ve long believed that The Biggest Untapped Solution to Climate Change is in the Water. But belief isn’t enough—you need protected technology that makes your solution viable at scale.

Case Study: Renewable Energy Infrastructure

Hydropower clearly exemplifies how investment and intellectual property portfolios work together. Building sustainable energy infrastructure requires serious capital and cutting-edge technology to reduce costs, accelerate timelines, and mitigate risks.

This is where FDE Hydro(TM)’s work is critical. Our patented modular precast concrete technology, the “French Dam,” changes the economics of hydropower. We manufacture components in a factory and assemble them quickly on-site, replacing months or years of traditional construction. The time savings alone can be transformative for project financing.

The beauty of Modular Powerhouses is that they address multiple investor concerns: risk mitigation through factory-controlled quality, cost reduction as explained in Why Precast Cost Less, and timeline acceleration that completes projects in a fraction of the traditional time.

For investors, these factors directly impact ROI. A project that comes online faster generates revenue sooner. A project with lower risk has more predictable cash flows. A project with proprietary technology has lasting competitive advantages.

Our Massive I/P Portfolio covers the United States, Canada, Brazil, and Europe, allowing our technology to be deployed globally without fear of infringement.

This synergy creates infrastructure projects that are financially viable. Many renewable ventures fail due to unprotected technology, high costs, or long timelines. When innovation is backed by solid patents and capital, investors get returns, innovators can scale, and the world gets cleaner energy. That’s the intersection we’re working at every day.

Frequently Asked Questions about Massive I/P Portfolios

How many assets are needed for a “massive” investment portfolio?

The term “massive” in an investment context refers more to the scale of capital and breadth of diversification than a specific number of holdings. It’s not about hitting a magic number of stocks.

A portfolio of 60 stocks only captures 86% of true market diversification. To achieve genuine diversification across global markets and industries, you need exposure to thousands of securities.

This is why serious investors use low-cost index funds and ETFs for broad market exposure without managing thousands of individual positions. A “massive” portfolio is defined by its strategic allocation across asset classes like stocks, bonds, real estate, and alternatives, aligned with your risk tolerance and goals. A well-built portfolio might use a few select funds to gain exposure to thousands of underlying securities.

What makes an intellectual property portfolio valuable?

For intellectual property, quality trumps quantity. A few strong, defensible patents protecting core technologies are far more valuable than a cabinet full of weak ones. Value comes down to several key factors:

- Strategic Importance: Does the IP protect technologies critical to your competitive advantage? At FDE Hydro(TM), our patented technology is the foundation of our business, allowing us to deliver Modular Powerhouses faster and more cost-effectively.

- Commercial Potential: Can you license the IP for revenue or use it to create products customers want? The best IP opens multiple revenue streams.

- Market Relevance: Valuable IP addresses current or emerging market needs. As the world recognizes that The Biggest Untapped Solution to Climate Change is in the Water, our hydropower innovations are perfectly positioned.

- Defensibility: Can your patents withstand legal challenges? A patent that crumbles under scrutiny is worthless. Strong IP creates a real defensive moat.

Who is the typical investor for these types of portfolios?

The answer depends on which type of Massive I/P Portfolio we’re discussing.

For investment portfolios, investors are diverse. They include affluent individuals and family offices who require sophisticated strategies to preserve and grow wealth, as well as institutional investors like pension funds, endowments, and sovereign wealth funds. These groups have the capital and long-term perspective for large-scale, diversified approaches, focusing on strategic Assessing Your Risk Tolerance.

For intellectual property portfolios, the “investor” is often a corporation developing or acquiring IP to dominate a market, a research institution, or a specialized IP holding company. Private equity and venture capital firms are also major players, investing in the future potential of protected innovation. They know that in capital-intensive sectors like renewable energy, strong patent protection can be the difference between success and failure.

At FDE Hydro(TM), we understand both sides. We have the investment strategies to fund large-scale infrastructure and the patents across the US, Canada, Brazil, and Europe to protect our technology. This dual perspective helps us bridge the gap between groundbreaking ideas and the capital needed to realize them.

Conclusion

We’ve explored the dual meaning of Massive I/P Portfolio, and it’s clear that whether discussing financial assets or intellectual property, both are crucial for building lasting value.

On the financial side, a massive portfolio is built on thoughtful diversification across asset classes and strategic risk management. It’s not about picking hot stocks but achieving broad market exposure, often using alternative strategies to find uncorrelated returns and manage volatility.

On the innovation side, a massive IP portfolio is both armor and sword. It protects what makes you unique, deters competitors, and signals to investors that you have a real, defensible asset. In sectors like renewable energy, strong IP is the difference between leading the market and being a spectator.

At FDE Hydro(TM), we live at this intersection. Our patented modular precast concrete technology (the “French Dam”) is protected across the US, Canada, Europe, and Brazil. This Massive I/P Portfolio allows us to deliver faster, more cost-effective, and reliable hydropower solutions. We also understand the investment side, knowing that Financing Long-Term Hydropower Requires Mitigating Risks Prior to ROI, which our protected technology helps achieve.

This dual perspective—understanding how to protect innovation and how to attract the capital to scale it—is what allows us to create lasting value. We’re not just building dams; we’re building a sustainable future for renewable energy infrastructure.

If you’re curious about our specific technologies, we invite you to Discover the innovative methods and technologies powering the next generation of infrastructure investments. Whether you’re an investor or an innovator, there’s never been a more exciting time to be part of this change.