Canada’s Emerging Role in the Global Crypto Mining Industry

Canada crypto mining has positioned the country as the world’s fourth-largest Bitcoin mining hub, trailing only the United States, China, and Kazakhstan. Here’s what you need to know:

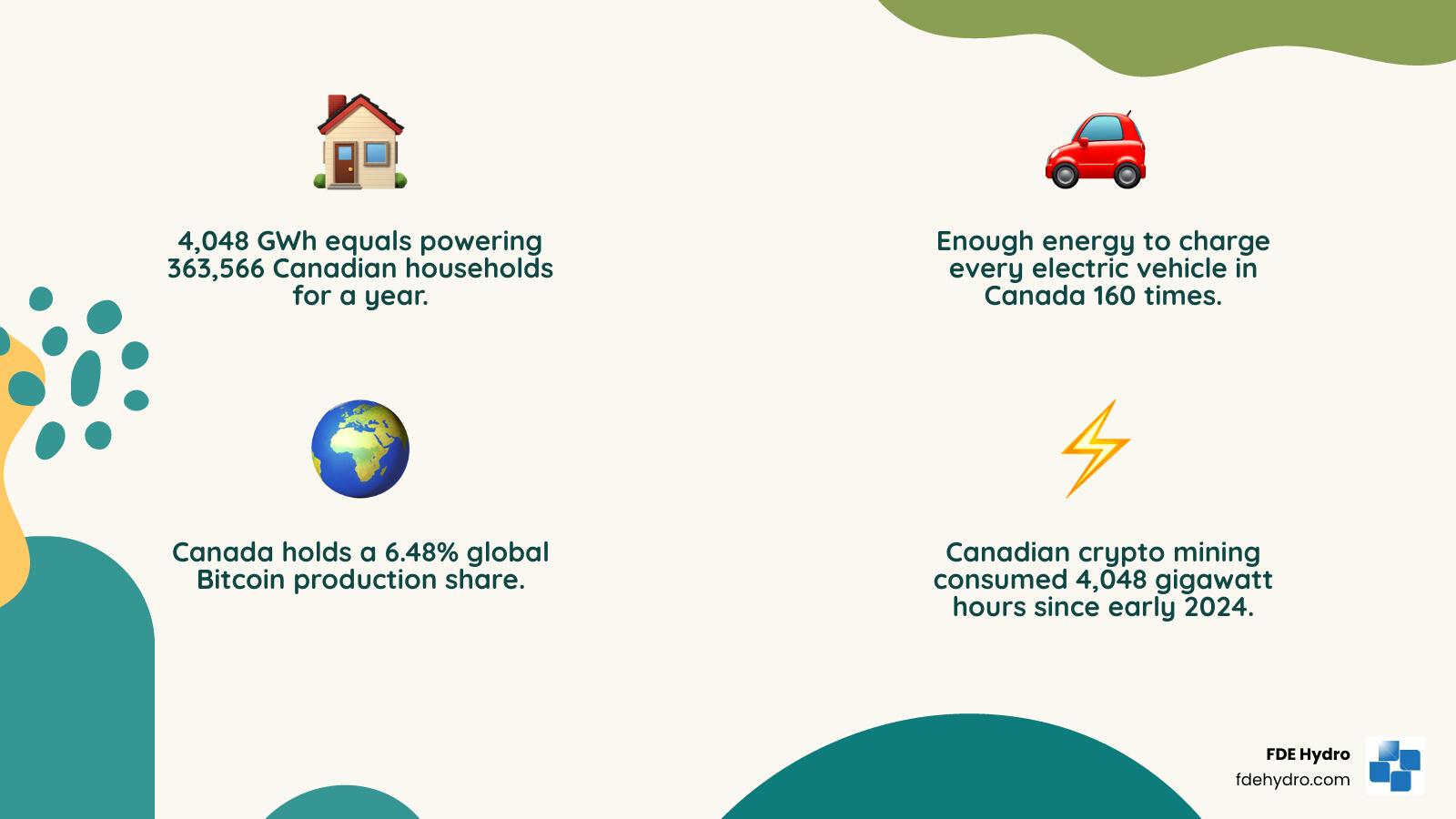

- Global Production Share: Canadian facilities produce 6.48% of all Bitcoin mined globally

- Energy Consumption: 4,048 gigawatt hours consumed since the start of 2024

- Financial Impact: $424.2 million in electricity expenditure (based on $0.10/kWh average rate)

- Regulatory Environment: No specific mining license required, but tax obligations apply through the Canada Revenue Agency (CRA)

- Key Advantage: Access to abundant, relatively low-cost electricity, particularly from hydroelectric sources

The country’s cold climate and stable political environment make it attractive for mining operations, but the April 2024 Bitcoin halving event doubled the energy required to mine a single Bitcoin—from 407,059 kWh to 850,219 kWh—significantly impacting profitability.

Why does this matter for infrastructure leaders? The massive energy demands of crypto mining are creating unprecedented opportunities for innovative power solutions. My experience with the Department of Energy’s hydropower task force and my work at FDE Hydro has shown that Canada crypto mining operations need what we prioritize in hydropower: reliable, cost-effective, and sustainable energy. Success hinges on efficient infrastructure that minimizes capital expenditure and accelerates project timelines.

The Landscape of Canada Crypto Mining: Energy, Costs, and Scale

Canada’s cold climate, stable governance, and affordable electricity have made it the world’s fourth-largest Bitcoin mining hub. This success, however, comes with a significant energy cost.

Bitcoin mining is an energy-intensive global race where specialized computers (ASICs) solve complex puzzles to validate transactions and earn new Bitcoin. Operations in Canada range from small-scale enthusiasts to industrial warehouses with thousands of rigs. For all of them, a constant, reliable, and affordable power supply is the single most critical factor for profitability.

Electricity Consumption and Grid Impact

The energy consumption of Canada crypto mining is staggering. Since the start of 2024, operations have used 4,048 gigawatt hours of electricity, costing an estimated $424.2 million. This is enough energy to power over 363,000 Canadian homes for a year or charge every electric vehicle in Canada more than 160 times.

This massive demand places real pressure on power infrastructure, as large mining operations can strain local grids. For energy infrastructure professionals, this challenge presents a clear opportunity to develop and deploy scalable, reliable power solutions. You can explore more detailed global data through the Cambridge Bitcoin Electricity Consumption Index.

The Halving’s Effect on Profitability

The Bitcoin “halving” is a pre-programmed event that cuts the mining reward in half, occurring roughly every four years. The April 2024 halving dropped the reward from 6.25 BTC to 3.125 BTC per block, fundamentally changing the economics for Canada crypto mining operations.

Overnight, the energy required to mine one Bitcoin more than doubled. This forces miners to find cheaper electricity or invest in more efficient equipment to remain profitable. Efficiency has never been more critical. A recent study breaks down these dramatic shifts in detail.

| Metric | Before April 2024 Halving | After April 2024 Halving |

|---|---|---|

| Bitcoin Block Reward | 6.25 BTC | 3.125 BTC |

| Energy to Mine 1 BTC | 407,059 kWh | 850,219 kWh |

| Cost to Mine 1 BTC (at $0.10/kWh) | $42,656.06 | $89,095.14 |

Key Players in Canada Crypto Mining

The Canadian crypto mining scene features several major players adapting to the evolving market.

- Hut 8 (TSX:HUT) is one of Canada’s largest operators, with data centers across North America offering self-mining, hosting, and managed services. The company has shown significant growth and has announced ambitious expansion plans, including developing new sites and partnering with technology providers like Bitmain to improve its mining capabilities.

- SOL Strategies (CSE:HODL, NASDAQ:STKE), formerly Cypherpunk Holdings, pivoted to focus exclusively on the Solana blockchain. Instead of mining Bitcoin, they invest in Solana projects and operate validators. This strategic shift has been met with positive investor sentiment.

- Bitcoin Well (TSXV:BTCW, OTCQB:BCNWF) focuses on making Bitcoin accessible to everyday Canadians through a network of Bitcoin ATMs and an online portal. The company has reported significant growth in its customer base and continues to build its Bitcoin reserves.

Navigating the Rules: Crypto Mining Regulations and Taxes

While the cryptocurrency world can seem unregulated, Canada has established clear rules for crypto mining, woven into existing tax and business laws. For anyone involved in Canada crypto mining, understanding these frameworks is essential for legal compliance and profitability.

Unlike some countries, Canada does not require a specific “crypto mining permit.” Instead, the Canada Revenue Agency (CRA) applies existing tax laws, while provincial governments regulate electricity and business operations. The key is understanding how the CRA views your mining activities and what that means for your tax obligations.

The CRA’s Stance: Hobby vs. Business

The CRA evaluates each mining situation to determine if it’s a business or a hobby, a distinction that significantly impacts taxation. Factors include the regularity of mining, profit motive, and the scale of your operation. A few rigs running occasionally might be a hobby, while a dedicated facility is clearly a business.

- If mining is a business, the fair market value of mined coins is considered taxable income upon receipt. Any subsequent sale can also trigger capital gains. This income must be reported on your tax return like any other business.

- If mining is a hobby, tax obligations are generally limited to capital gains when you sell the crypto.

The CRA encourages voluntary disclosure for past unreported crypto income, which can help reduce penalties. Maintaining detailed records of all transactions, costs, and sales is crucial for compliance. For official guidance, refer to the Mining cryptocurrency – Canada.ca page.

Understanding GST/HST for Mining Activities

Businesses involved in Canada crypto mining must also steer the Goods and Services Tax (GST) and Harmonized Sales Tax (HST), governed by the Excise Tax Act. Section 188.2 of the act defines cryptoassets and mining activities.

Following legislative changes effective February 5, 2022, the provision of a mining activity itself is generally not considered a taxable supply for GST/HST purposes. This means miners typically do not charge GST/HST on their mining services. The trade-off is that they generally cannot claim Input Tax Credits (ITCs) on related expenses like electricity and equipment.

The CRA distinguishes between mining groups (where members share risks and rewards) and mining pools (where an operator pays for computing power), which affects GST/HST application. The rules are complex and evolving, so consulting the official Mining Activities in respect of Cryptoassets notice and seeking professional accounting advice is highly recommended.

Regional Hotbeds and Sustainability Efforts

Canada’s diverse energy landscape has created distinct regional hubs for Canada crypto mining, each with unique advantages. As the industry grows, however, it faces increasing pressure to operate sustainably.

Canada’s cold climate provides natural cooling for heat-generating mining rigs, a significant geographic advantage. This, combined with a strong commitment to renewable energy, positions the nation uniquely. The central question is no longer just if we can mine, but if we can do so responsibly.

Provincial Powerhouses: Quebec, Alberta, and Atlantic Canada

- Quebec was an early magnet for miners due to its abundant, low-cost hydroelectricity and cold climate. However, a surge in demand led Hydro-Québec to impose a moratorium on new operations in 2018 to protect the grid. Pre-existing facilities continue to benefit from the province’s green energy.

- Alberta became a key player by offering greater flexibility, with both on-grid and off-grid solutions. Its diverse energy market, including natural gas and renewables, allows miners to negotiate competitive rates.

- Atlantic Canada, particularly New Brunswick, attracted miners like HIVE Blockchain Technologies when Quebec’s market tightened. New Brunswick’s 80% non-emitting energy grid, powered by nuclear and hydro, allows companies to market their Bitcoin as “green.”

Some operations act as “flexible load centers,” consuming surplus power during off-peak hours. This “reverse battery” strategy helps utilities balance the grid and demonstrates how mining can integrate with, rather than just strain, existing infrastructure.

The Future of Canada Crypto Mining: The Push for Sustainability

The conversation around Canada crypto mining has shifted from profitability to responsibility. While the industry’s energy consumption is high, Canada’s reliance on clean energy sources like hydropower creates “green Bitcoin” with a lower carbon footprint than crypto mined elsewhere using fossil fuels.

Hydropower is the foundation of sustainable crypto mining in Canada, providing the consistent, renewable power needed for 24/7 operations. This is where infrastructure innovation is critical. At FDE Hydro, our patented modular precast concrete technology—the “French Dam” approach—accelerates the construction and retrofitting of hydroelectric facilities. By reducing costs and timelines, we make clean energy more accessible for energy-intensive industries in Canada, the US, Brazil, and Europe.

Innovation also extends to byproducts. Waste heat from mining rigs, traditionally vented, can be repurposed for district heating or to warm agricultural greenhouses. Another frontier is flared gas mining, where natural gas that would otherwise be burned off at oil wells is captured to power mining operations, turning an environmental liability into a productive asset.

This push for sustainability is becoming a competitive advantage. Miners who can prove their operations run on renewable energy are better positioned for future partnerships and market leadership.

Frequently Asked Questions about Crypto Mining in Canada

Here are straight answers to some of the most common questions about Canada crypto mining.

Is crypto mining still profitable in Canada?

Profitability is not guaranteed and depends on several key factors:

- Bitcoin’s Price: Higher prices directly increase the value of mining rewards.

- Electricity Cost: This is a miner’s largest expense. Access to low-cost power, particularly from hydro sources, is a major advantage in Canada.

- Hardware Efficiency: Newer ASIC miners produce more hashes per watt, making them more competitive. Outdated equipment can quickly become unprofitable.

- The Halving: The April 2024 halving cut mining rewards in half, effectively doubling the cost to mine a single Bitcoin.

In short, profitability is challenging but achievable, especially for large-scale operations with efficient hardware and access to cheap, renewable energy. For hobbyists, it has become much more difficult.

What are the main risks of mining cryptocurrency in Canada?

While there are opportunities, Canada crypto mining involves significant risks:

- Regulatory Changes: Federal and provincial rules for crypto are still evolving. Changes to tax laws or energy policies, like Quebec’s 2018 moratorium, can happen quickly.

- Energy Price Volatility: Electricity rates can fluctuate due to market demand, weather patterns, and policy changes, directly impacting profitability.

- Environmental Scrutiny: The industry’s high energy consumption draws public and governmental concern, which could lead to stricter regulations or fees.

- Global Competition: Canadian miners compete with operations worldwide, some of which may have lower energy costs or more favorable regulations.

- Hardware Obsolescence: Mining equipment has a short lifespan and requires significant capital investment, with a high risk of rapid depreciation.

- Market Volatility: The price of Bitcoin and other cryptocurrencies is notoriously volatile, meaning the value of mining rewards can plummet unexpectedly.

Do I need a license to mine crypto in Canada?

No, there is no specific federal “crypto mining license” in Canada. However, you must comply with several existing regulations:

- Business Registration: If you operate as a business (which the CRA will likely assume for any serious operation), you must register it provincially and federally.

- Tax Registration: You must register for and handle GST/HST once your revenues exceed the threshold.

- Provincial Utility Regulations: You must secure power agreements and permits from local utility providers, which often have specific rules for large energy consumers.

- Zoning and Local Bylaws: Your facility must comply with local zoning, noise, and building codes.

While there’s no single license, navigating these business, tax, utility, and municipal requirements is essential for legal operation.

Conclusion

Canada crypto mining is a story of balancing innovation with responsibility. Our nation has become the world’s fourth-largest Bitcoin mining hub by leveraging its political stability, abundant energy, and cold climate. However, this success is challenged by massive electricity consumption and the economic pressures of events like the 2024 Bitcoin halving.

The future of the industry in Canada will be determined by its commitment to sustainability. The operations that thrive will be those that accept renewable energy, particularly hydropower, as their foundation. Offering “green Bitcoin” powered by Canadian hydroelectricity is not just a marketing advantage; it’s a step toward building a more responsible digital economy.

The regulatory landscape will continue to evolve, requiring careful navigation of tax and utility rules. But these frameworks are designed to ensure the industry grows in a way that benefits the economy without compromising our grid or environmental goals.

This is where we see our role at FDE Hydro. Our patented modular precast concrete technology—the “French Dam”—makes building and retrofitting hydroelectric facilities faster and more affordable. We are helping create the sustainable energy infrastructure that forward-thinking industries need, whether for mining in Canada or renewable projects in the United States, Brazil, and Europe.

The path forward is clear: Canada crypto mining must be powered by clean, reliable energy. The operations that recognize this today will lead tomorrow. Canada has the resources and expertise to set the global standard for responsible cryptocurrency mining.

To explore how sustainable hydropower infrastructure can support your energy-intensive operations, we invite you to Learn more about hydropower solutions.